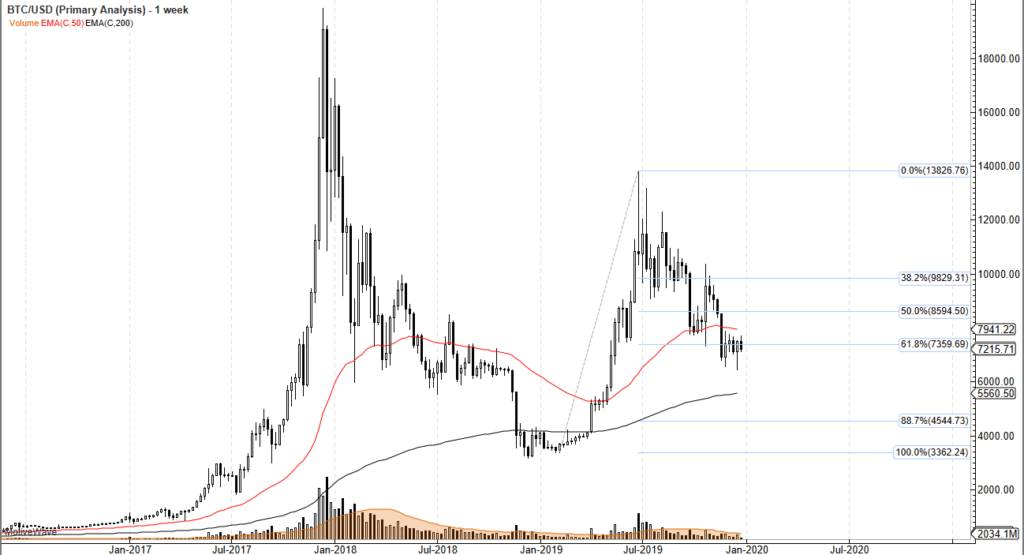

Is Bitcoin Trying to Make a Stand Finally?

- 8% Fibonacci retracement level being tested

- Market stuck between two major moving averages

- Previous week formed a hammer

Bitcoin has been falling for quite some time, reaching down towards the $7200 level. Over the last couple of weeks though we have seen a bit of a pushback, which suggests that the market will continue to struggle. However, it is very likely that the market is starting to see a confluence of forces in both directions.

Technical Analysis

Bitcoin Weekly Chart

The technical analysis for Bitcoin is starting to look better than it had previously, but there are still a lot of concerns out there. The question remains not so much as to whether or not the market can bounce, but whether or not it will be a simple bounce, or an attempt to continue going higher.

It should be noted that the 61.8% Fibonacci retracement level will attract a certain amount of interest anyway, and clearly, over the last couple of weeks, we have stalled in the downward pressure. Having said that, the market has fallen quite far so traders will begin to look at whether or not the downtrend can continue. To put it bluntly, Bitcoin has been a disaster for several months now.

Alternatively, if the market were to break down below the hammer from the previous week, that could unleash a move towards the $5500 level, which is where the 200-week moving average currently resides.

All things being equal, this will continue to be an area where one would expect a lot of volatility in choppiness, but eventually, the markets will form an impressive candlestick. Once it happens, then we should get some follow-through. Keep in mind that this is the midst of the holiday season, so it’s difficult to imagine that there will be a lot of money flowing in and out of the markets. When we get to January 6, more liquidity will flow into all the markets and we will probably get our next move.

Trading going forward

Trading going forward will more than likely be somewhat quiet over the next couple of weeks, but we are most certainly in an area where a lot of traders will be paying attention to a larger move. When we get the next impulsive candlestick, in other words, one that is relatively strong in one direction or the other forms, then the market will show what it’s about to do going forward. The next couple of weeks will be difficult but we are clearly at an inflection point for the market, and although trading at the moment might be hard, we should get some clarity relatively soon.