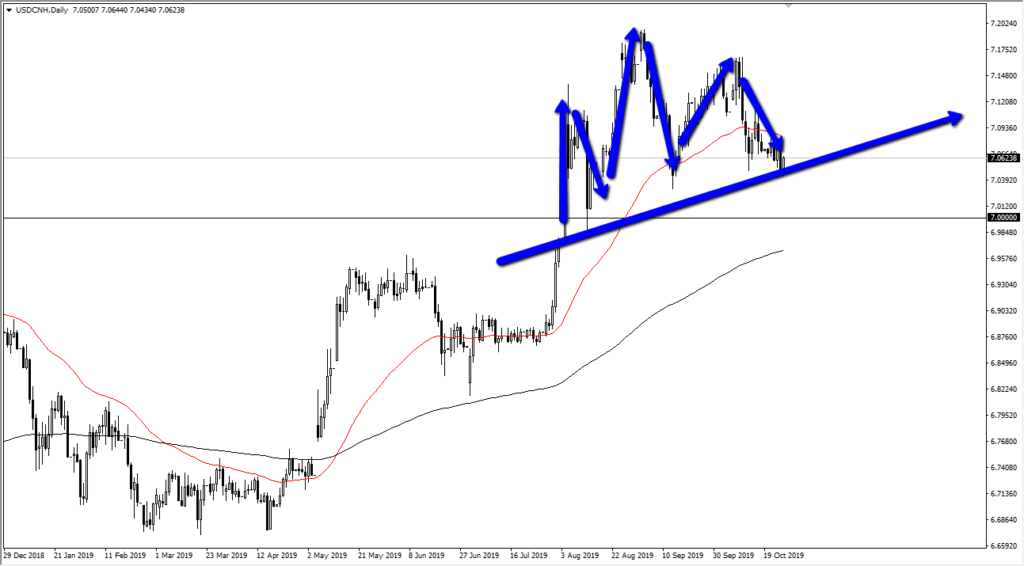

Is the Chinese Yuan Ready to Rally?

- Possible head-and-shoulders pattern

- Below the 50-day EMA

- Potential 7-level test

Over the last couple of months, the USD/CNH currency pair has attracted more attention than usual, mainly due to the US-China trade relations breaking down. Because of this, it makes sense that the US dollar has rallied for some time, being considered a much safer currency than the Chinese yuan. After all, if Chinese exports to the United States are going to slow down, then demand for that currency will drop. However, as “Phase 1” looks likely to be signed after the latest round of talks, it is providing some strength to the Chinese currency.

However, there is a significant level underneath that will cause quite a bit of attention. At the same time, there is also a potential head-and-shoulders pattern, so it is likely that the market will need to make a very serious decision soon.

Push and pull

USD/CNH chart

This market continues to get a line of “push and pull” from external forces. At this point, the market is still well above the 7-yuan level, which was major as far as psychology is concerned.

The headlines due to the US-China trade situation will continue to be a major driver of where we go next. The fact that it looks at least a little like a conciliatory tone has caused the pressure on the US dollar in this currency pair to drop a little. However, there is a significant amount of support underneath, and it is probably going to take some very strong headline to break through that level.

Beyond that, the 200-day EMA is sitting just below that psychologically important 7 level and will attract a lot of attention by longer-term traders anyway. The head-and-shoulders pattern break to the downside should reach towards the 6.8 yuan level.

The 7-yuan level will attract a lot of headline noise. So, with that in mind, pay attention to this level regardless. Not only could it determine where this currency pair goes, but it could also have a lot to do with what risk appetite does around the world, in including stocks, bonds, precious metals, and the like.

If this pair continues to go much higher, that is a sign the trouble is around the corner. Even if you are not a Chinese yuan trader, this is a very important economic indicator that far too many retail traders do not pay attention to. If nothing else, it’s a great risk barometer.