New Zealand dollar pulls back to support against Canadian dollar

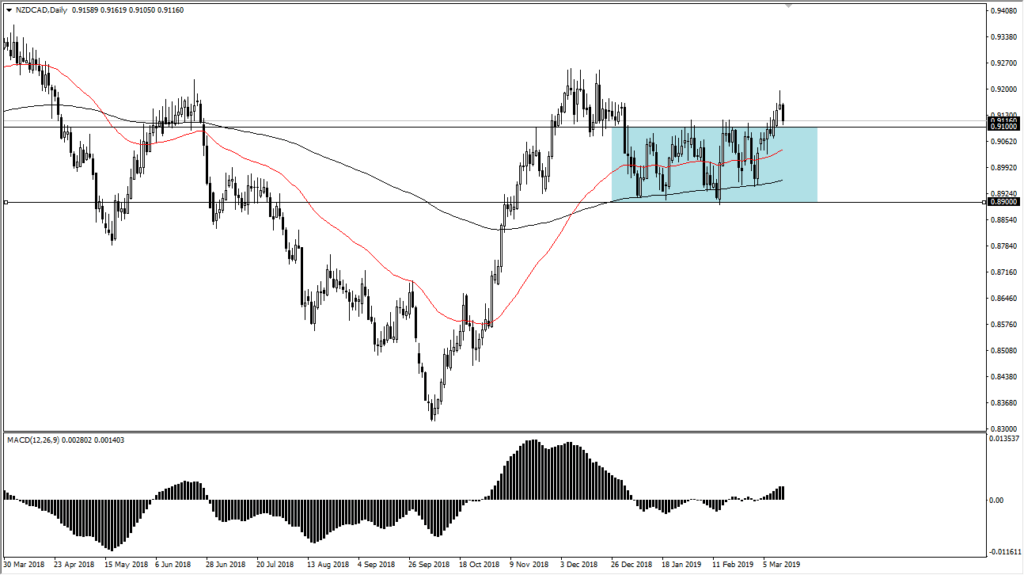

Looking at the NZD/CAD pair, we have formed a shooting star during the trading session on Tuesday, but then pulled back on Wednesday to test the top of the previous consolidation area. This is a market that features a couple of commodity currencies, so therefore it is going to be a bit noisy as commodity markets tend, at least on the surface, to move in tandem.

Will previous resistance offer support?

The question now is whether or not the previous resistance at the 0.91 level will now offer support. So far, we have stopped at that level during the daily candle, and short-term traders seem to be willing to step in and pick up the New Zealand dollar at this level. That being said, there is a lot out there that could move the commodity markets, as the New Zealand dollar seems to be relatively strong, but at the same time the Canadian dollar is struggling a bit. Because of this, it’s likely that there will continue to be a bit of interest here.

Beyond that, the 50 day EMA, pictured in red on the chart, it could offer support as well. All things combined, it certainly looks as if there’s probably more of a proclivity to buy this market than to sell it. However, anything is possible, so a break down below the 50 day EMA then opens the door to the 200 day EMA, pictured in black on the chart, looking for buyers there as well.

nzd/cad daily

Asia and crude oil

One of the things that you should keep in mind when trading currencies of course is going to be the fundamental drivers. The two biggest fundamental drivers in this pair is going to be related with Asian growth and crude oil demand. The New Zealand dollar is highly levered to the Asian economy, as it is essentially the “grocery store” for places like China and Indonesia. On the other side of the trade, there is the crude oil market which has a massive influence on the Canadian dollar, which quite often traders will use as a proxy for trading crude.

As I write this article, crude oil is trying to break out but it does seem to be holding at the $58 a barrel price in the WTI grade. This offers a little bit of support in this market, especially if we can get some type of good news coming out of the US/China trade relations. Another driver of the New Zealand dollar can be the commodities markets in general, at least as far as agriculture products are concerned. If milk and the grains do fairly well, as a general rule the New Zealand dollar will as well.

Potential targets

Looking at this chart, there are a couple of potential targets depending on which direction we go. If we rally from the 0.91 handle, it’s very likely that we will go looking towards the 0.9250 level, an area that has caused a bit of resistance. On the downside, the 50 day EMA, as mentioned previously pictured in red, could be the initial target, then the 200 day EMA after that. Overall, I would need to see some type of daily close below the 0.91 level to believe that the sellers were going to step up again. Until then, it’s very likely that there is probably more upward pressure than down. Beyond that, the MACD has been picking up a bit of strength as well, which is also a very bullish sign.