NZD/JPY flashes Ominous Signal

When it comes to risk appetite, there are a handful of currency pairs that tend to offer hints as to where we may be going. The New Zealand dollar against the Japanese yen is one of the situations, as the Japanese yen is without a doubt one of the “safety currencies”, while the New Zealand dollar represents commodities, albeit mainly agricultural, which means, of course, it is associated with markets wanting to take on risk.

Major reversal candle

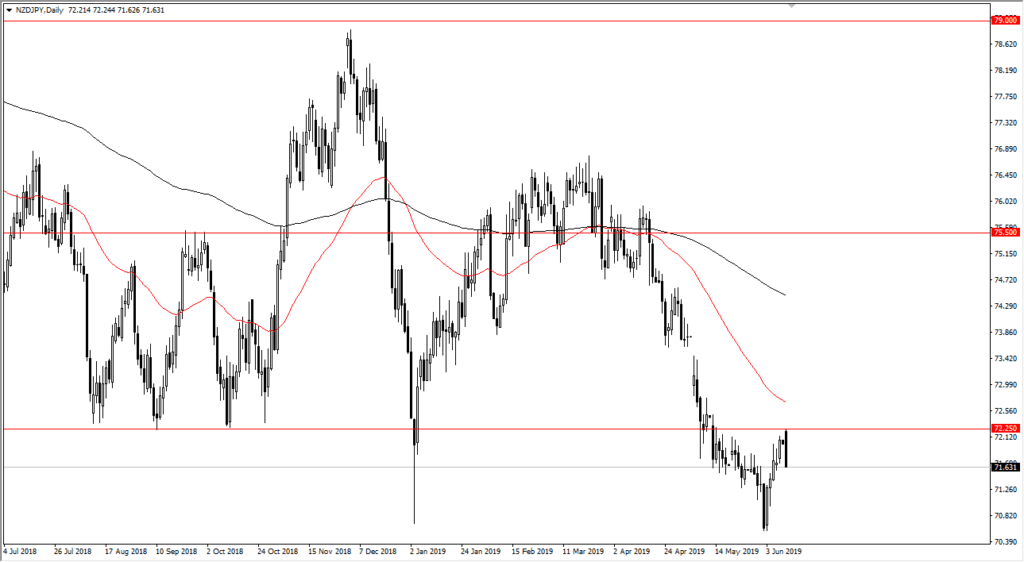

Just a few days ago, the New Zealand dollar rallied quite nicely against the Japanese yen, reaching towards the 72.25 level, an area that has been important previously. Because of this, going into the weekend it looked as if we were going to try to continue to go higher, perhaps reaching towards the gap closer to the 73.75 handle. However, as we opened up on Monday after gapping into that resistance line, the market has fallen straight down.

The result was that we ended up forming a bearish and golfing candlestick, which is an extraordinarily negative sign. The fact that it occurred where it did, of course, adds even more credence to the bearishness in this market, and now one has to wonder whether or not this would translate into other marketplaces?

NZDJPY Daily June 10th

Monday Blues for the Kiwi

What has been most interesting is that while the JPY related crosses all gapped higher, this is the only one that not only filled the gap but broke down significantly. Because of this, it shows just how much negativity there could be in the New Zealand dollar overall. Even the Australian dollar, which did not do very well during the day, managed to rally against the New Zealand dollar. In general, the Kiwi dollar looks as if it is in a bit of trouble.

By following the way it has, it has presented a major reversal signal, which of course will attract a lot of attention. In fact, it’s not until we break above the 72.25 level that buyers will feel any sense of confidence, and even then I would be a bit cautious.

Points Gathered From the Chart

The main take away is that the downtrend is very much intact. We have the 50 day EMA pictured in red just above the 72.25 handle, and most certainly have had a very rough day. Beyond that though, even if you don’t trade this currency pair you have to wonder how commodities would do going forward. After all, the New Zealand dollar tends to move with the overall commodity market, and we had seen quite a mixed bag when it came to commodities around the world on Monday. Gold fell hard, oil tried to rally but gave back quite a bit of the gain, and several other minor commodities fared poorly as well.

Does this signal a major risk off move coming? It may, and you will probably see it in several different marketplaces. However, for this pair, it looks as if we may go looking to test the lows again, near the 70.50 mid-century mark.