Pound set to pull back

Shooting stars

Looking at the British pound against three other major currencies, we ended up forming shooting stars on both Wednesday and Thursday. This is true against the Japanese yen, the US dollar, and the Swiss franc. One would have to think that this is no coincidence, and it’s very likely that we are going to see a little bit of profit taking going into the weekend. After all, to form a couple of shooting stars in a row is of course a very negative sign. When you see it happen in multiple instances, that of course is an extremely negative sign.

What does it mean?

At the end of the day, there are people out there willing to bet against Sterling regardless of what’s going on. While it does look like we could pull back from here, quite frankly it is probably the market trying to catch his breath after an explosive move higher. We started the week out by gapping higher, which of course is a bullish sign and it has not been filled since. It is because of this that technically speaking, this pair should go back down to fill that gap. This could lead to weakness over the next couple of sessions. At the end of the day though, it should simply end up being a buying opportunity for those who are patient enough.

The British pound has bottomed

Under most circumstances, the British pound will have bottomed previously, somewhere near the 1.20 level. While most of the “Remainers” see this guy falling, the reality is that the British pound is historically cheap at these levels. Big money will come in and pick up currencies when there cheap, and simply sit on them until the profitable. This is exactly what we are starting to see in this market, as the British pound is a bit more comfortable closer to the 1.50 level against the greenback.

Beyond that, the only circumstance that looks plausible for markets to go lower and make a fresh, new low is if we get some type of “no deal Brexit.” However, keep in mind that the European Union has a whole plethora of its own issues. Looking back several years from now, some people might believe that this is Great Britain dodging a major bullet.

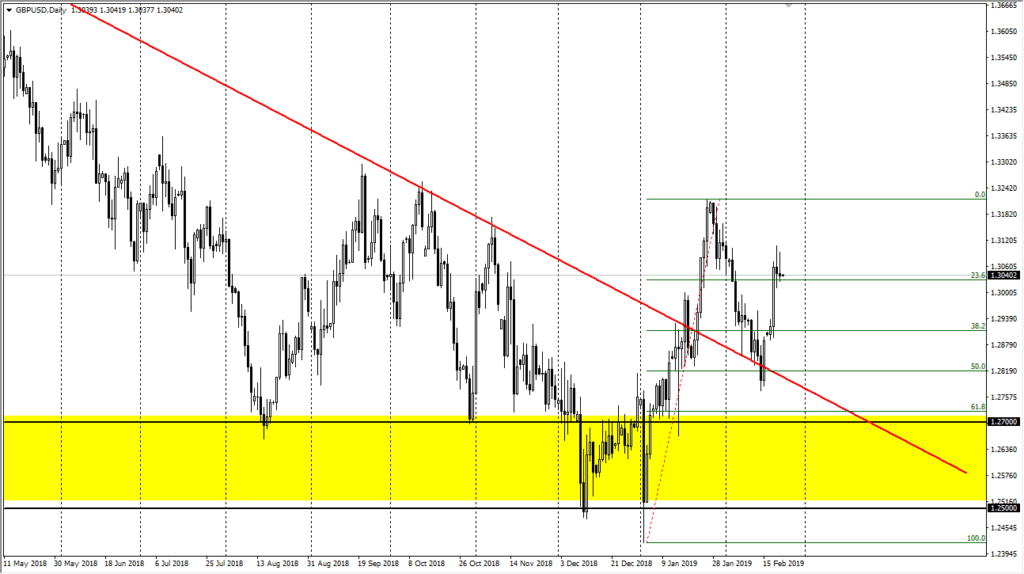

Beyond that, we have recently broke through a major downtrend line, pulled back to the 50% Fibonacci retracement level on that same line, and rallied quite nicely. This pullback should allow a lot of people who have missed out on the rally to get involved, something that many people will be desperate to do. Below there, we have the 1.27 level which also features the 61.8% Fibonacci retracement level. With all of these things lining up at the same time, it makes a lot of sense that this pullback will probably just offer value the people are willing to take advantage of.

What if we don’t pull back?

If we don’t pull back, we will have broken the top of a couple of shooting stars, which is an extraordinarily bullish sign. That being said, it should probably bring in more people into the market as they would be afraid of missing out of the momentum. At this point, the scenario looks as if we get a pullback, then it’s time to buy at lower levels. If we break out to the upside, then it’s time to buy at higher levels.

The Federal Reserve, and other central banks

The Federal Reserve has made it plain and upfront that they are willing to go very easy if needed. It is because of this that the upward momentum and value of the greenback has probably seen its heyday. Because of that, it makes sense that a lot of value hunters will continue to send the British pound higher. Against the Swiss franc, we could really start to see some momentum come into play as the Swiss National Bank is probably one of the easiest central banks around the world as far as monetary policy is concerned. And for the third currency mentioned in this piece, the Japanese yen – the Bank of Japan is notoriously loose at almost all times. If we get any uptick in risk appetite, that will send GBP/JPY much higher.