RBNZ Leaves Rates on Hold as New Zealand Dollar Recovers

- RBNZ leaves rates untouched

- Suggests coronavirus is a short-lived issue

- New Zealand dollar recovers to test 0.65 level against US dollar

- NZD against other currencies may be advisable

The Reserve Bank of New Zealand took center stage early on Thursday as an interest rate decision came out. It was unchanged as anticipated, but there was an optimistic tone to the statement that lifted the markets and took Kiwi dollar traders by surprise.

One of the key quotes was “The December unemployment rate unexpectedly dropped to 4%, Q4 headline CPI at 1.9% y/y was a little faster than expected and house price inflation picked up into the end of last year. The better data can be linked with the 75 bps in rate cuts announced by the RBNZ last year in addition to the government’s increase in fiscal spending.”

Perhaps even more important to the market in the short term is that the RBNZ suggested that any coronavirus impact would more than likely be short-lived. The resulting action afterwards was a huge drop in expectations regarding further interest-rate cuts from New Zealand, and a major increase in the value of the New Zealand dollar.

That being said, the RBNZ looks set to remain on hold as far as interest rates are concerned. This is a sign of strength in essence, simply because it isn’t as bad as once thought. Whether or not the New Zealand economy grows is still up for debate, but the RBNZ forecasts that economic growth will accelerate over the second half of 2020 on the back of both monetary and fiscal stimulus coming out of the government.

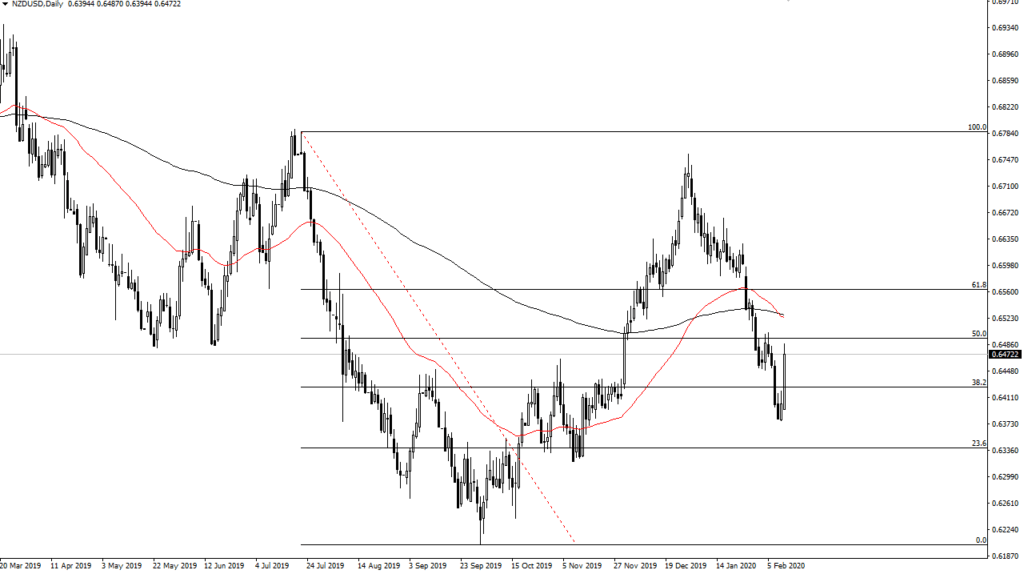

Technical analysis on the NZD/USD

NZD/USD yearly chart

The New Zealand dollar rallied significantly on the back of the statement, as it wasn’t as bad as anticipated. The 0.65 level against the US dollar was tested, and as of New York trading it is holding as resistance. That being said, there is also the 50-day EMA turning lower and reaching towards this area so the rally may or may not continue.

A daily close significantly above the 0.65 level would be a major victory for the New Zealand dollar, perhaps opening up the door to the 0.66 level. Otherwise, a pullback to the 0.64 level would make sense as the market may have gotten a bit overexcited by the “less bad” statement.

Furthermore, the United States still outperforms most of the rest the world, so perhaps the best play for buying the New Zealand dollar will be against other currencies such as the Japanese yen in more of a “risk-on” type of environment.