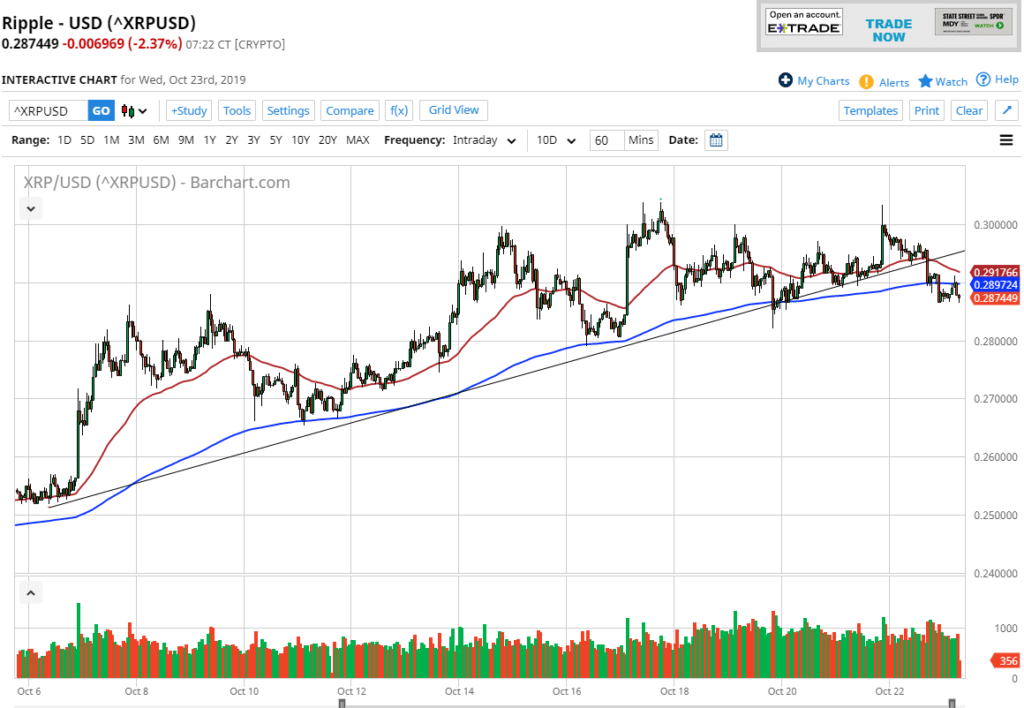

Ripple Poised for a Further Downturn

- Broken trend line to the downside

- 200 EMA just above

- Crypto slumping in general

The Ripple markets have been sideways for quite some time, as cryptocurrency markets have struggled to gain a footing. With that, market participants have shown a proclivity to simply go sideways and do nothing. Meanwhile, central banks around the world doing everything they can to boost them by cutting interest rates, adding quantitative easing, and many other schemes.

Ripple, of course, is a relatively small coin and therefore secondary to places in markets like Bitcoin. Bitcoin has struggled quite a bit recently and has broken through a descending triangle, which of course is a very ominous sign for other cryptocurrencies such as Ripple, Ethereum, Litecoin, and many others. Quite frankly, if Bitcoin cannot take off to the upside, none of these other markets have any significant chance.

Trend line break

The trendline that has recently been broken had been very supportive for some time, but then got broken. The 200 EMA has been broken through to the downside, showing signs of rolling over and breaking down from there as well. With that being the case, it’s likely that the $0.28 level could be targeted, perhaps even lower than that.

Technical analysis

The technical analysis for this pair is, of course, that the trend is starting to change. Now, it is only a matter of time before a breakdown kicks off a shorting opportunity. At this point, cryptocurrencies look like they are sliding. Most profit will be made shorting these markets.

Below the $0.28 level, the next support level is at the $0.27 level, and then eventually the $0.25 level. To the upside, there is the 50-day EMA, which is crossing the $0.29 level, and the previous trendline, both causing significant resistance. With that in mind, it’s very likely that rallies will be sold into as well.

Ripple technical analysis

Fundamentally broken

It’s only a matter of time before the crypto markets will need to be whittled down to a few viable coins. Ripple may be viable due to the fact that it allows for transactions internationally through large banks, but the question is whether or not those banks choose to use it for their own coins, something that Ripple has to deal with.

Recently, it was seen to be the case. It’s likely that the market will stay viable over the longer term, but clearly it can’t hold significant value. The oversupply of coins for the market currently will continue to put downward pressure, especially if the “King” of crypto, Bitcoin, cannot get much of a bid these days. At this point, the crypto markets are starting to reflect real value and less speculative pressure.