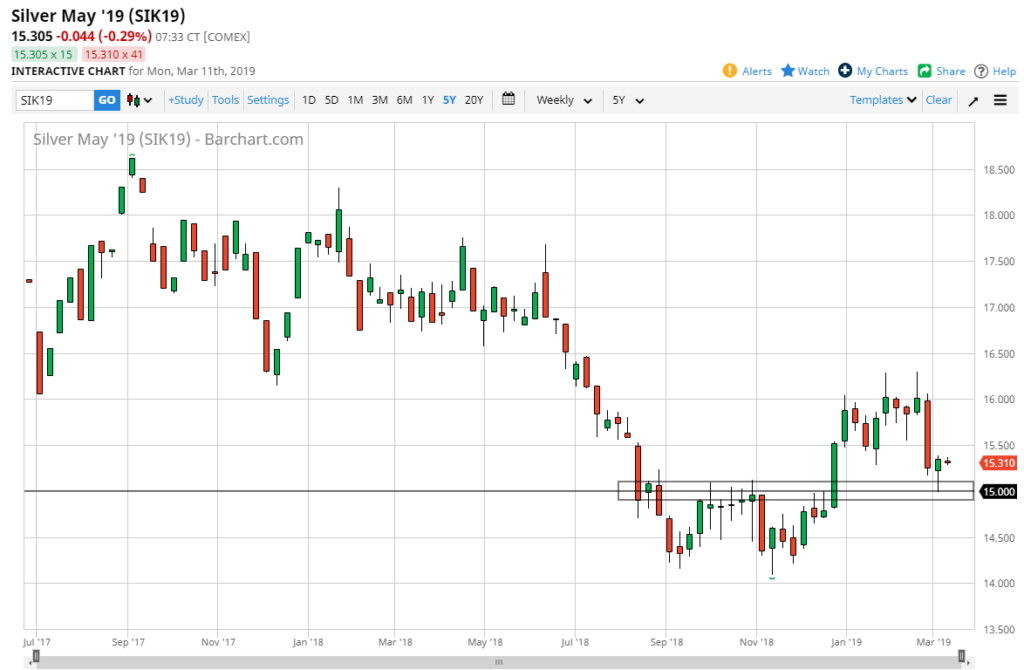

Silver markets form strong supportive candle

Silver markets spent most of last week drifting lower but has found the weekly candle to end up forming a massive hammer, which of course is a bullish sign for technical traders. By doing so, and the fact that we are doing so at such a major round figure, it certainly will attract a lot of attention towards the precious metals markets.

The jobs number

Part of the reason we are seeing a bit of a recapturing of bullish pressure in the precious metals markets would be the less than stellar jobs number that was printed on Friday out of the United States. This of course has the greenback rolling over a bit, and as both silver and gold are measured in US dollars, it makes quite a bit of sense that we are starting to see them turn around. It wasn’t only silver though, the candle stick by the end of the day on Friday for gold was very impressive as well.

The main take away is that with a soft jobs number, and the fact that we already know the Federal Reserve is likely to be on the sidelines, it’s quite possible that we may get plenty of cheap money, which is always a good thing for sound money such as silver and gold.

$15

Obviously, the $15 round figure will capture a lot of attention, as it is not only a large, round, psychologically significant number, but it is also an area that had previously been resistance, so it should of course be supported on the other side. Ultimately, the time you are near a round figure like this, it tends to bring out a lot of order flow in both directions. With that being the case, it’s very likely that we will see a lot of volatility on short-term charts, but it certainly looks as if we are ready to try to take back some of the losses from the previous week.

Silver Weekly

It’s not just the Federal Reserve

Central banks around the world are starting to soften their monetary policy stance, as seen by the European Central Bank press conference on Thursday. With both the Americans and the Europeans on the sidelines and easing their monetary policy, or at the very least in the case of the Americans standing on the sidelines, there’s almost nothing to keep precious metals down for a longer period of time. Beyond that, we also have the Peoples Bank of China adding liquidity measures to the market as well. As central banks around the world flood the markets with cheap money, people naturally will look to gold, and then secondly to Silver. Gold markets do tend to have a bit of a “knock on effect” when it comes to Silver, Dragon it right along with it over the longer-term.

The alternate scenario

Obviously, there’s always two sides to every trade. If we were to break down below the candle stick for the past week, which is right at the $15 level, then you would have to begin to worry about whether or not the buyers are coming back. However, when you look to the left on this chart, you can plainly see that there’s been a bit of a “W pattern” formed, and it now looks very likely to have been the bottom. Silver look very healthy based upon this pattern, so if it fails that’s going to be a very negative sign indeed.