South African Rand Shows Demand for Emerging Markets

- USD/ZAR continues to show massive resistance

- Continuing downward pressure from earlier move

- Move comes despite recent rate cut

Thursday the South African Reserve Bank cut its interest rate by 25 basis points from 6.5% down to 6.25%. It came as a real surprise, as most economists believed that it was going to sit still. This should, in theory, drive the value of the South African Rand lower.

The Rand attempted to fall in value, reaching the 14.50 level against the US dollar. However, the charts are telling a different story than what would be expected.

Technical analysis

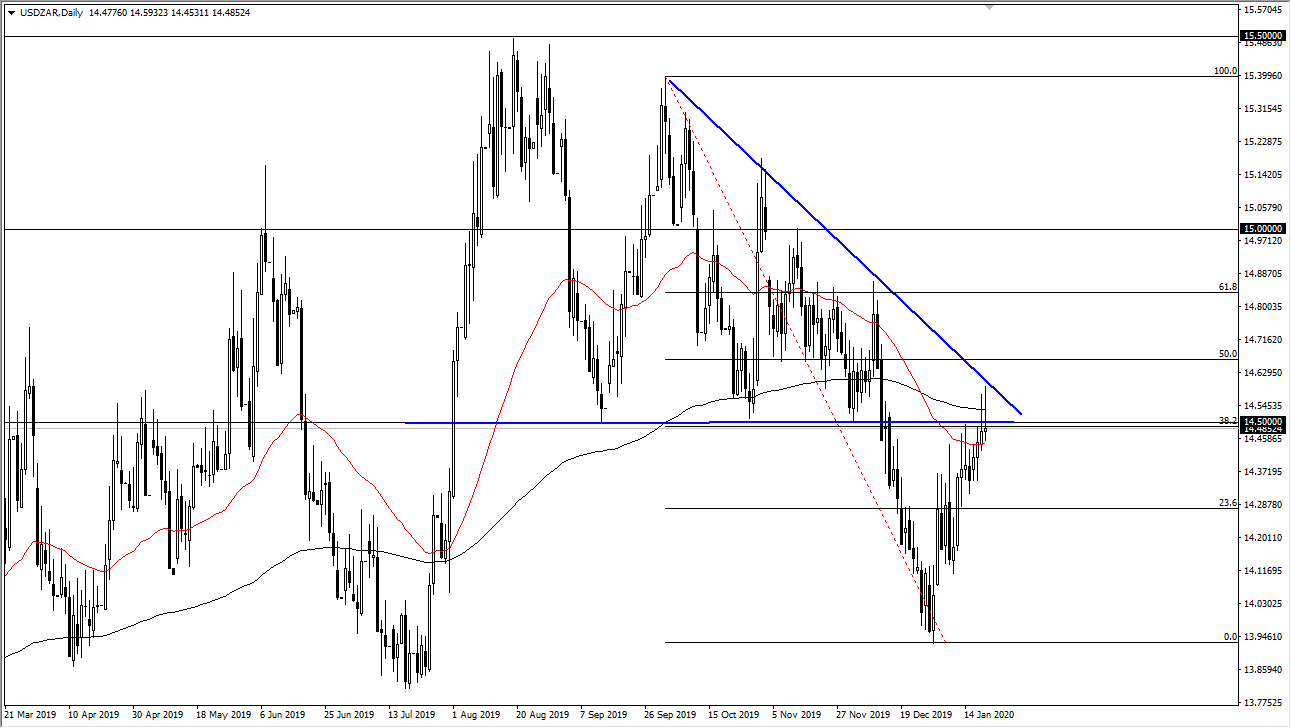

USD/ZAR daily chart

The technical analysis for the USD/ZAR pair is very interesting, considering it doesn’t necessarily go along with what would first seem to be the most likely of scenarios. Granted, the US dollar has appreciated against the rand over the last couple of trading sessions, but it has seen a huge push back in favor of the South African currency.

In fact, near the 14.50 level, the market pulled back to form a shooting star on Monday, and Tuesday is looking very much the same. Furthermore, we also have the 200-day EMA in the area that will attract a lot of attention.

That being said, the 14.50 level is also an area that had previously been supportive, as shown by a massive descending triangle on the chart. It is also worth noting that it is the 38.2% Fibonacci retracement level that falls down to the lows.

The fact we have seen the market show so much resistance in this area suggests there is still plenty of downward pressure in the pair. As a general rule, if the 38.2% Fibonacci retracement level holds on a pullback, it typically shows quite some longer-term momentum.

What this resistance could mean

There are a couple of things that could serve as a takeaway from the technical analysis showing so much in the way of resistance locally. The first would be that there is potential US dollar weakness, something that is starting to be seen against some major currencies. But it would be a bit of a stretch to think that’s the entirety of the reason.

Even with a 6.25% interest rate, South Africa is far more attractive than the United States. If traders out there are willing to take a certain amount of risk, the rand might actually be a proxy for other emerging markets such as Mexico, Latin America, Southeastern Asia, and the like. Perhaps, money is starting to look for yield again, forcing it into some of the smaller high-yielding currencies.