US CPI, Unemployment Claims Show Mixed Economy

- CPI less than anticipated

- Core CPI came in as expected

- Unemployment Claims perform better

Early on Thursday, the United States released Consumer Price Index figures, both the headline number and for the Core CPI, as well as the Unemployment Claims for the week. These numbers were quite mixed, but it should be noted that the US dollar is getting quite a boost from the euro, which is falling apart. The greenback is somewhat impervious to poor economic numbers at the moment, perhaps as it is a relative play against other economies that are so much weaker.

The announcements were a mixed bag

The Consumer Price Index came out at 0.1% month over month, less than the 0.2% expected. However, that figure includes food and energy which are notoriously volatile. The Core Consumer Price Index month-over-month came out at 0.2%, as anticipated. This is the measurement of a basket of goods that the typical American would buy, minus the food and energy that the headline figure covers. This suggests that perhaps the market is right where it is anticipated to be for Americans.

The Unemployment Claims figure for the week was 205,000 new applicants, which was less than the 210,000 expected. This shows that the US employment situation still remains very strong, and therefore the USA continues to lead the rest of the pack as far as that is concerned. Ultimately, this is a significant string of mixed data yet again, as we continue to see coming out of the United States.

Having said that, most economic figures coming out of places like Europe are negative, and of course there is the coronavirus happening at the same time. This means that people continue to throw money at the United States, and furthermore bond yields continue to favor the US as well. With the 10-year note offering 1.57%, as opposed to most European notes offering negative yields, it makes sense that we continue to see the US attract capital inflows.

The greenback and its reaction

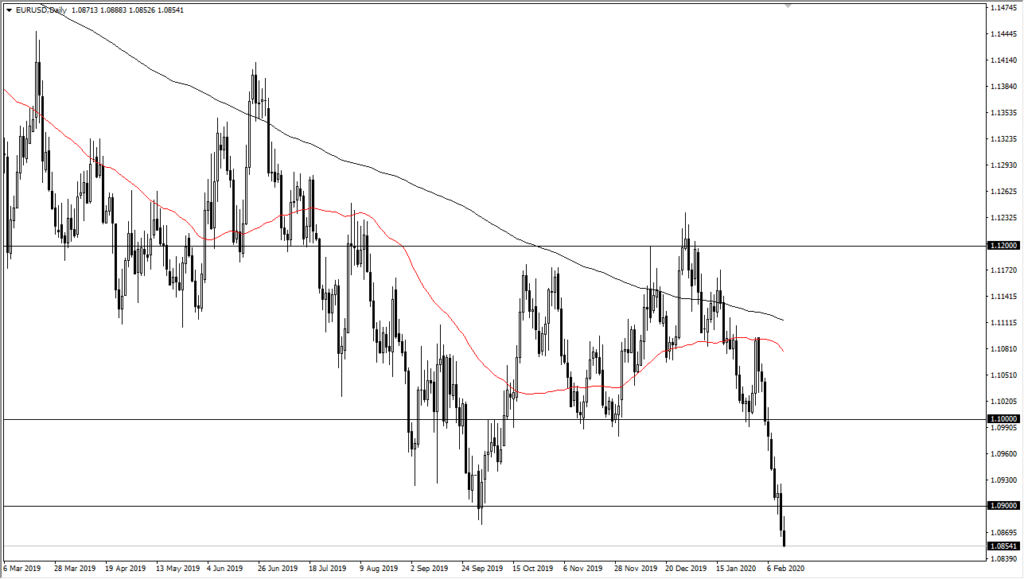

EUR/USD yearly chart

The US dollar has initially tried to rally during the trading session in a bid to recover, but after the CPI announcement, it has continued to fall as it is reaching towards the 1.0850 level at the time of writing. The US dollar has fallen against the Japanese yen and the British pound, but noise coming out of London as far as a shuffling of the cabinet by the Prime Minister seems to be market-friendly and therefore it shows that the British pound is reflecting stability in the UK.

Gold markets are drifting a little lower, which is positive for the dollar as well, so as you can see the greenback is somewhat mixed, even though it has been extraordinarily resilient. This should continue to be the overall attitude of the market, and it should be noted that in the case of the Australian dollar and Canadian dollar, the US dollar is overextended so this could be a little breather.