West Texas Intermediate Crude continues to grind

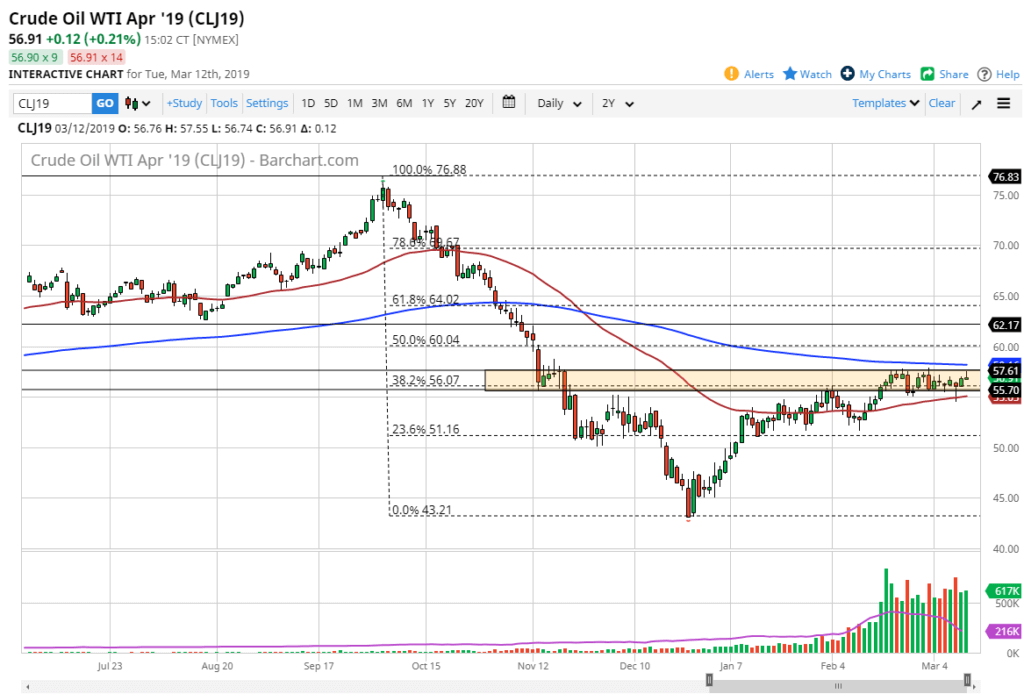

Crude oil traders have been frustrated yet again during trading on Tuesday, as we reached towards the top of the overall range that we have been in for several weeks, only to turn around and form a shooting star. While this is technically a bearish side, we have seen a resilient support level underneath that continues to keep the market afloat. With that, we are simply stuck in this overall area and have been relegated to back-and-forth scalping.

The range

The $58 level above features resistance as we have seen over the last couple of weeks, but it now features the 200 day EMA as well. That of course offers resistance, so the fact that we pulled away from there is not a huge surprise. After all, even though we had a nice bullish run over the last couple of days, there was no real catalyst to push prices higher over the longer-term. The markets have simply been grinding away in this range, and nothing has changed.

To the downside, the $55 level continues to be very supportive, and the hammer from the Friday session only added more credence to that level. Beyond that, the 50 day EMA is sitting in that area as well, so this is a market that most certainly has quite a bit of support built into it as well.

WTI Crude Oil

Short-term charts

Short-term charts continues to be a major help for those who are willing to get in and out of the market rather quickly, but for those who are looking for some type of investment or longer-term trade, this certainly is not the market for you currently. Until we can break out of this range, we will continue to see more of the same.

The bullish scenario

The bullish scenario is that we break above the $58 level, and close on the daily chart above the 200 day EMA. Then we could go looking to fill the gap above at $61, and then perhaps break above there as well. What is worth noting is that the gap above also features the 50% Fibonacci retracement level, so even if we get to that level it’s not exactly going to be an area we slice rate through.

The bearish scenario

If we break down below the 50 day EMA, and perhaps even the hammer from the Friday session, then the market is very likely to drop down to the $52.50 level, although it will be rather choppy as we have a lot of recent order flow in that area. Another thing that leads some credence to the bearish scenarios the fact that we formed a shooting star for the trading session. Overall, the market continues to be very noisy but it certainly looks as if we cannot break out anytime soon.

US/China trade deal

While we are concerned about global growth, the only other thing that is going to help crude oil is going to be if the Americans and the Chinese come together. If they do, then that should naturally bring up demand for crude and that could send it to the upside rather significantly. However, if that deal falls apart it’s likely that we will break down here because of the perceived lack of demand coming down the pike.

Until we get some type of certainty out of that situation, we may be in a bit of a holding pattern in this market, because quite frankly we just don’t know where to go. OPEC is cutting production, but at the same time the Americans are ramping it up.