Euro continues to grind higher against Swiss franc

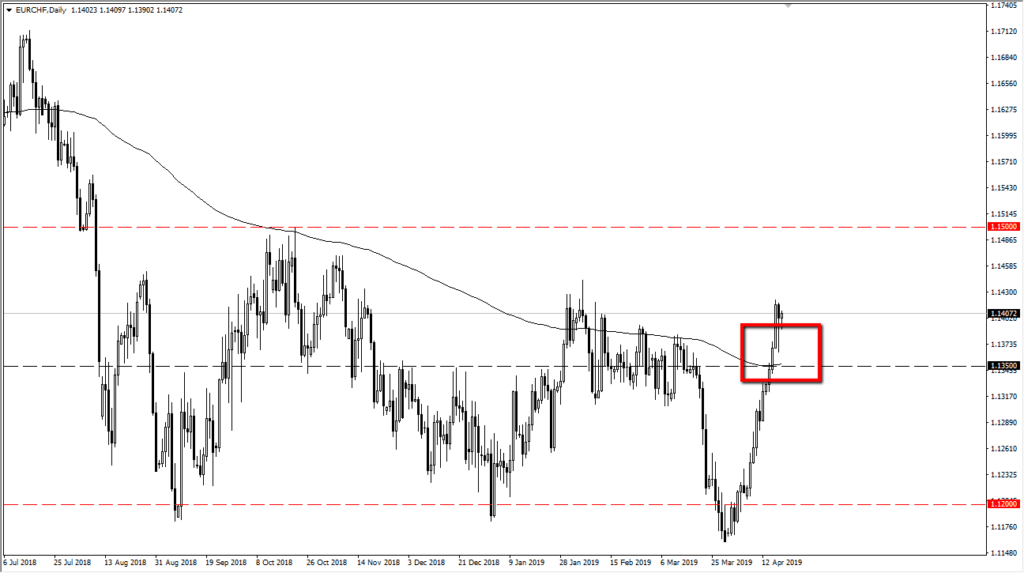

The Euro initially fell on Friday and low liquidity but then turned around to show signs of strength. We ended up forming a candlestick very similar to the one on Thursday, and this of course could lead to a much bigger move as we are pressing against major resistance.

The technical set up

The technical set up for this pair is that we have shot straight through the air like being fired out of a cannon. With this Swiss National Bank being so loose with its monetary policy, it makes sense that we would see the Swiss franc suffer. Quite frankly, as the Euro has been getting hammered against so many other currencies, this chart shows just how soft the Swiss franc is.

The fact that when we dip we find buyers willing to step in just above the 1.1350 level, and perhaps even more tellingly the 200 day EMA, it shows that the market is willing to pick this market up. In fact, the 1.1350 level looks very likely to be massive support due to the fact that we have recently broken through a lot of noise when you look to the left.

If we can break to a fresh, new high then there’s not much standing in the way of going to the 1.15 handle. That of course is a large, round, psychologically significant figure and of course a scene of massive selling in the past. That is what the charts are saying we are aiming for. The question is whether or not we can reach there in the short term? It’s possible that we continue to bounce around in this area but if we get some type of bounce in the EUR/USD pair, then it should only strengthen the position of the Euro over here.

EUR/CHF daily chart

Alternate scenario

As with any other set up, there’s always an alternate scenario. If we were to close below the 1.13 level on a daily chart, we will have wiped out which should’ve been supported, and of course broken significantly below the 200 day EMA. At that point it’s very likely that we would turn around and fall towards the 1.12 handle. Ultimately, that probably accompanies some type of breakdown against the US dollar by the Euro as well. If we were to break below the 1.1150 level against the US dollar, then a sell off over here could be very brutal.

The main take away

The last couple of weeks have been very bullish to say the least. Beyond that, the last couple of days have seen aggressive buying on the dips, so it’s very likely that we should continue to go higher. Will we break out right away? Probably not, as we need to build up the necessary momentum. Currently I believe the 200 day EMA is going to be massive support, assuming that we even get down to that area. A move to the upside will struggle at the 1.15 handle, but we have clearly moved into a fresh new zone of trading.

However, if the Euro fails against the US dollar -which of course is the main measuring stick of all currencies – then it stands to reason that we may break down over here as well.