Australian dollar running into resistance

The Australian dollar has risen again during the day on Monday but is starting to run into major resistance. At this point, the market is still in a relatively bearish stance, so it makes sense that eventually the sellers will show up. This week it makes even more sense than usual, so I am currently waiting for a sell signal.

50 day EMA

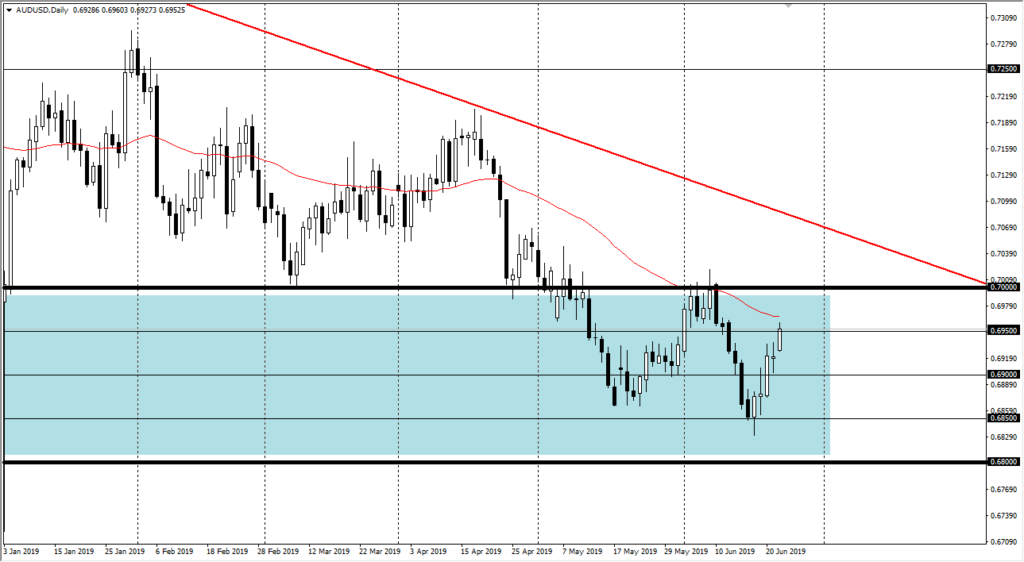

AUD/USD Chart

Looking at the chart, you can see that the 50 day EMA sits just above price. That of course is a major technical level for longer-term traders, and we have of course been in a major downtrend for some time. Overall, I believe that this market probably finds reasons to sell off, and the 50 day EMA may simply be the excuse.

You can see that we have already pulled back a bit from that level early in the day, so the selling off of the Aussie dollar may be starting already. Regardless, the 0.70 level above is major resistance as well, so from a technical standpoint it seems very unlikely that we can continue to go much higher without a major shift in attitude.

US/China

The US/China trade relations will of course be a major driver of where the Australian dollar goes as the Aussie dollar is so highly correlated to the Chinese economy. Remember, Australia supplies China with most of its hard materials when it comes to not only construction but also manufacturing. With the US/China trade relations all over the place, it’s very likely that we will continue to see a lot of volatility when it comes to this currency.

With the G 20 going on over the weekend, between now and then the market may try to anticipate any good news, but quite frankly there’s been nothing lately that suggests the Americans and the Chinese or anywhere near trying to work things out. If that’s going to be the case and it does turn out to be true, then it’s likely that this pair will drift lower. Quite frankly, the only reason this market has rallied at all has been due to central bank policy.

Central bank policy

Central bank policy also will dictate what’s going on as well, as per usual. That being said, it’s very unlikely that we will be able to glean anything good out of central banks around the world as the Federal Reserve is now shifting to a very dovish stance. The RBA is also potentially going to cut rates in the future as well, so don’t be surprised at all if this market to simply sits in the blue box that we have been in.

Selling probably makes more sense, but I wouldn’t necessarily expect some type of massive break down, as the 0.68 level underneath is massive support. The market has been trading in 50 pips increments, and quite frankly there’s probably nothing on this chart that suggests that’s about to change. If we did break out of this blue box, then we could have a major break out but right now that doesn’t look likely.