Australian dollar trying to make a stand

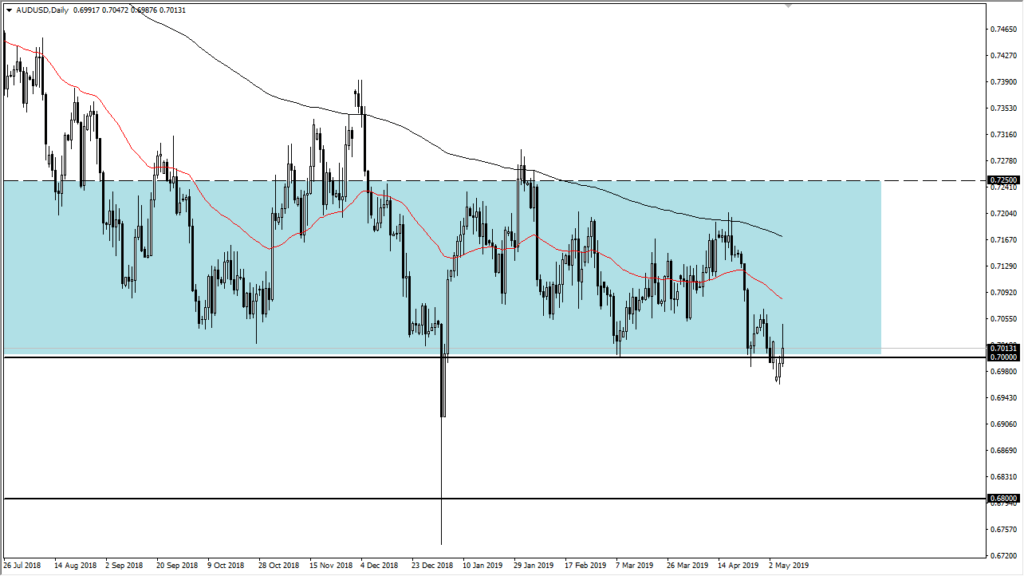

The Australian dollar rallied rather significantly early during trading on Tuesday, as we continue to meander around a very important level. By doing so, it looks as if we are trying to reestablish the 0.70 level as crucial. If that’s going to be the case, then it’s very likely that we could have a nice trade setting up.

Major support level

AUD/USD pair

The 0.70 level has been crucial for quite some time, offering major support on longer-term charts. With that being the case it’s not a huge surprise that we have turned around to fill the gap from the open of the week and shot towards the 0.7050 level. Breaking above that level could send this market much higher, as it would be a victory by the bullish. On the other hand, even if we do break down from here it’s very unlikely that we can continue to go lower, perhaps reaching down to the 0.68 level. The 200 PIP range is massive, so at this point in time the only thing you can do is go long of this market if you are involved at all.

Risk on/risk off

Remember that this pair is essentially a “risk on/risk off” type of situation. The Australian dollar tends to do better in risky situations, meaning that people are willing to put a lot of risk out there into the marketplace. If we find ourselves in that situation, it’s very likely that we will continue to see the Australian dollar gain from here. However, the US dollar is one of the major safety currencies, so if there are major concerns out there about financial trouble or even geopolitical trouble, the US dollar tends to do quite well.

Because of this, the one thing that you should be paying attention to more than anything is going to be the overall attitude of markets. The stock markets have shown a bit of resiliency, so at this point I think that there is probably more risk to the upside then down. That doesn’t mean it’s going to be easy though.

Your next hurdle

Your next hurdle is the 0.7050 level, and if we can break above there then we are more than likely to go towards the 0.7150 level. At this point, the pair has done quite well buying on dips, so I suspect that will probably continue to be the case. Ultimately, I am a buyer of this pair and not a seller, simply because it’s easier for this market to go higher than lower.

The US dollar

The US dollar of course is going to be a major player when it comes to what happens next in this market. If you notice that the US dollar is falling in value against most other currencies, then the Australian dollar should do fairly well. However, if you find that the US dollar is strengthening in against most currencies, you don’t want to sell this pair simply because you have 200 pips to fight through to get free. In that case, you probably want to buy the US dollar against several other currencies out there such as the British pound over the Euro.