Bitcoin to Test Major Support Level

- Bitcoin testing 200-day EMA

- Massive breakdown on Tuesday

- Short-term rallies the best hope

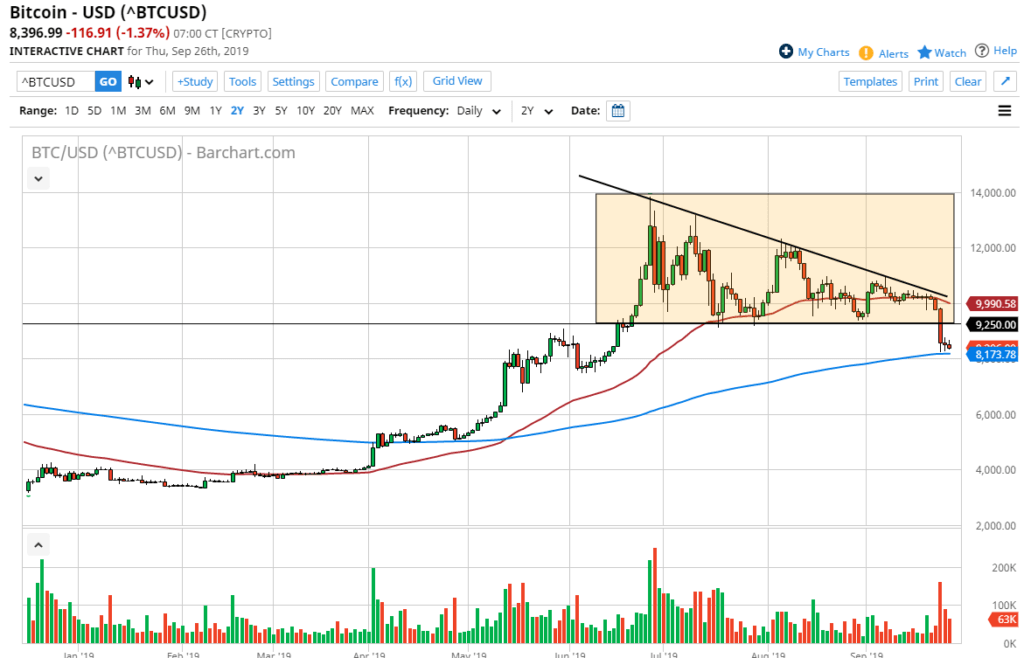

After breaking below the bottom of the massive descending triangle from several days ago, Bitcoin suddenly looks as if it is in a lot of danger. It has been digesting for quite some time, and as the highs started to get lower, concern started to creep into the marketplace.

the first major concern creeping into the market

Fundamental reasons

Bitcoin not bothering to rally over the last several months while gold was strengthening was the first major concern creeping into the market. After all, Bitcoin is supposed to be where traders hide from the depreciating value of fiat currencies.

Gold serves the same purpose, and as Bitcoin could not rally in that same time frame, it shows that perhaps crypto is starting to lose its luster again.

Major support level to be tested

Bitcoin is testing major support currently, as the 200-day EMA is sitting just back. The 200-day EMA being broken to the downside is a very negative sign for longer-term traders and would start a lot of money shorting this market, as algorithms will fire off. This being said, it’s likely that a short-term bounce could come into play, but the $9250 level above should be the beginning of significant resistance. This is due to the fact that it was the previous support of the larger consolidation triangle.

BTC technical analysis

Potential target

There is a potential target based on the previous triangle, in the form of $4800.

Ultimately, though, if the market was to turn around and recapture the 50-day EMA and break above the previous downtrend line, it would completely smash the idea of a breakdown and send the market looking towards the $14,000 level above. That being said though, it’s very unlikely to happen now that we have seen this massive drop on Tuesday, especially considering the large volume on that session as well.

Trading Bitcoin going forward

At this point, it’s very likely that short-term rallies will continue to offer selling opportunities for short-sellers, just as a breakdown below the 200-day EMA is another signal to start shorting. As far as buying is concerned, it seems very unlikely to happen anytime soon. Plus, the market would have to climb above not only the moving average but the trend line, essentially meaning capturing a $10,000 level on a daily close.

Position size should be kept small going forward, and then added to once the trade starts to work out in your favor. Keep in mind that, even though it looks as if it is going to break down, it is against the trend that the market has seen over the recent move, so certainly there will be fits and starts on the way down.