British pound likely to drift lower

The British pound has bounced slightly during Good Friday, but obviously liquidity would be a major issue. Simply put, we can’t put any thought into the way the day traded as speculation would’ve been nonexistent, and it simply would have been necessary transactions of international companies at best.

The importance of 1.30

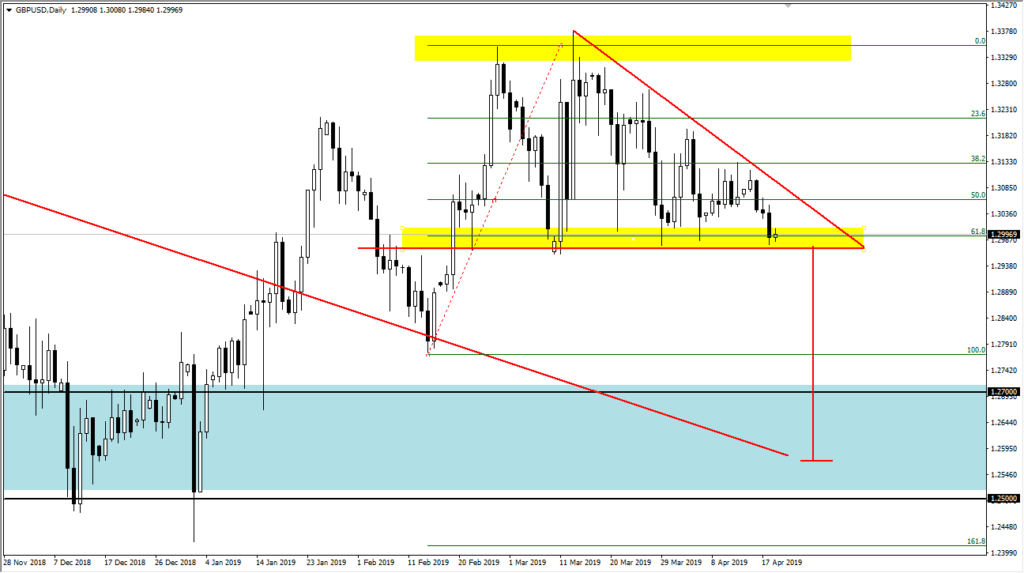

You should never ignore the importance of round, psychologically significant numbers, because these large numbers tend to attract a lot of attention. While it does seem a bit foolish, a lot of large numbers attract a lot of order flow. As you can see on the chart, the 1.13 level has been important more than once, and has kept the British pound afloat. However, it’s hard to ignore the fact that there is a significant downtrend line above that is forming a descending triangle. It is because of this that the 1.30 level has found itself to be even more important going forward.

If we break down below the 1.2950 level I would consider this area broken, and likely to open the market to much lower levels. You can see that I have a line drawn from there, reaching down towards the previous downtrend line that we have broken out of. The 1.27 level is the beginning of significant support, but we also have the 100% Fibonacci retracement level of the most recent move at the 1.28 level. That being said, the line does suggest the measured move that we could be looking towards. If we break the 1.30 level decidedly on a daily chart, these are all levels that we could be looking towards.

GBP/USD daily

No catalyst for British pound strength

It’s very likely that this pattern is a simple representation of how the market is losing volume and quite frankly interests. The extension of the Brexit for another six months means that we need to wait and see whether or not we can get a deal done before putting money to work in this pair. Beyond that, the US dollar has been strengthening in general, so we could continue to see a bit of downward pressure. This isn’t to say that we can’t bounce, obviously we can but right now it looks more likely to go down than up.

If we do finally get some type of resolution to the Brexit situation or at least assigned that we are moving forward, then it’s very likely that the British pound will hit a bit of a boost. Until then, it’s very likely that we just simply drift lower after the break out. It’s not very likely that we see some type of major meltdown, just that there’s no reason to buy this market.

The main take away

While it does look very negative, the reality is that we don’t necessarily have to sell signal quite yet. If we do break down then it’s very likely that we will go lower. The alternate scenario is that we break the downtrend line drawn in the triangle, which could open up a move higher, but it’s probably capped at the 1.3350 level which has been significant resistance as of late. In fact, we won’t be able to get above there without that Brexit deal. Again, it’s more likely that we drift lower than anything else.