Crude oil markets pull back after poor inventory figure

The WTI Crude Oil market had a wild ride during trading on Wednesday as the Energy Information Administration Crude Oil Inventories figure came out at a build of 2.8 million barrels, as opposed to the expected loss of 1.1 million barrels. This is very bearish, as we continue to see demand for crude oil fall. However, there are a lot of different things at work in the crude oil market currently that continue to slap the market back and forth.

Many technical factors at work

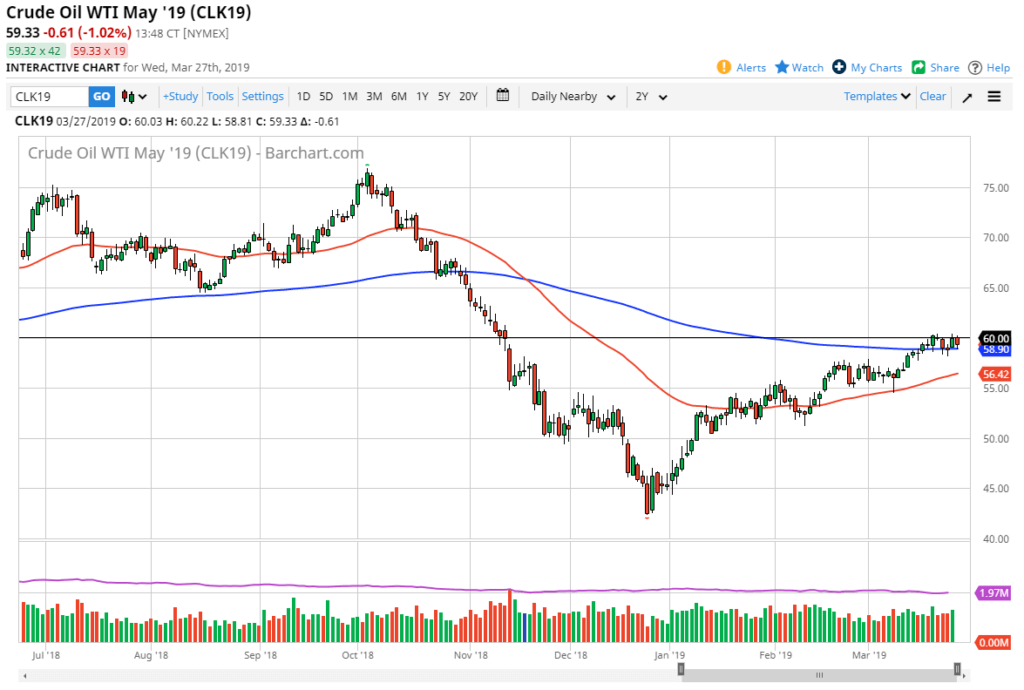

Looking at the charts, it’s easy to see that the $60 level is technically significant as it was the scene of a gap in November. We continue to bounce off of that level, as there seems to be a lot of selling pressure just above it. However, we also have a significant amount of support at the 200 day EMA near the $58.90 level, and therefore the market seems to be essentially “stuck” in this general vicinity.

The $60 level of course is a very significant round figure, but more importantly it seems to be the upper bound of the short term consolidation area. As we continue to see this consolidation, there’s no reason to fight it, rather we should look towards short-term charts in order to take advantage of what has been relatively reliable trading.

Beyond that, we have the 50 day EMA starting to rise, and it’s very likely that we are going to continue to see technical traders get involved and start pushing to the upside. That being said, any time you approached the 200 day EMA there seems to be a lot of back and forth initially, and then an impulsive move. We are simply waiting to see what that impulsive move is going to be. As things stand right now, even with negative headlines, we continue to see buyers step in so it’s very likely that we will eventually break to the upside.

WTI Crude Oil

Fundamental factors

There are certain amount of fundamental factors out there that continue to push the market back and forth, as the OPEC meeting has been pushed back until June, meaning that there is no chance of a production output increase between now and then. That in and of itself gives a little bit of a lift to this marketplace, and therefore it has a lot to do with why we continue to find buyers.

Even beyond that, we have the greenback and whether or not it’s going to rise or fall. If it does soften a bit, and it is a significant support levels again several currencies, it’s likely that a falling greenback will help push the crude oil market higher as well.

On the other side of the equation though, there are concerns about global growth. If global growth does in fact slow down enough, then you have to question whether or not there is going to be enough demand to drive pricing higher. One thing is for sure though, it certainly seems as if the market is focusing on the positive side of the equation rather than the negative.

Actionable observation

looking at the chart, it’s obvious that the buyers have been in control for some time. Furthermore, we have seen these consolidation areas a couple of times on the way appear, most specifically around the $52.50 level, and then the $55 handle. It’s very likely that we are simply in another one of those areas, and the fact that we did recover later in the day on Wednesday suggests that should continue to be the way forward.