EUR/GBP Continues to Sort Itself Out

- EUR/GBP pair broke down significantly to get to where it is

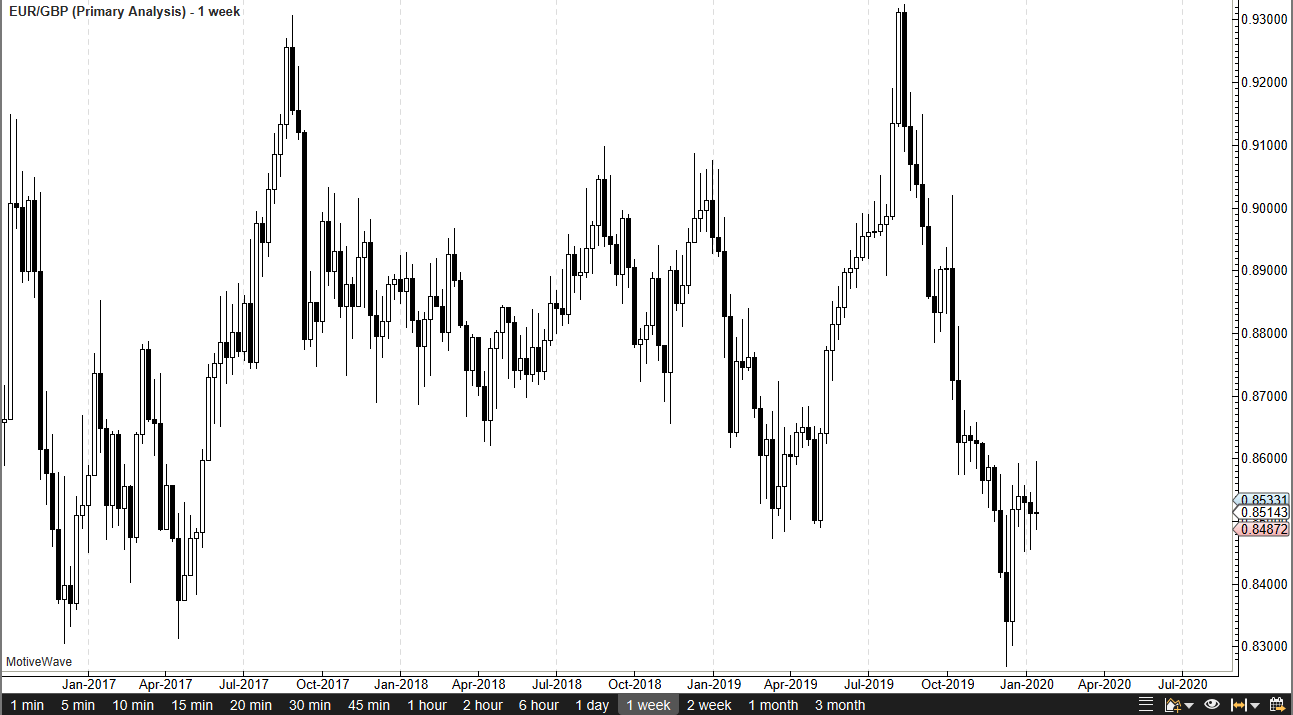

- The 0.86 level is resistance, 0.8450 offers support

- A potential battleground for the Brexit situation

One of the areas that will attract the most attention in the world right now will be the EUR/GBP pair as we continue to see a lot of questions about how the British will leave the European Union.

Obviously, this is “Ground Zero” when it comes to the negotiation, so it’s still very likely that the currency pair will continue to be very choppy. However, as soon as there can be some type of certainty with regard to the situation, this pair will make its next move – which could be relatively explosive.

Technical analysis

EUR/GBP weekly chart

The technical analysis for this pair is relatively tight, considering that there are a couple of obvious areas that offer both support and resistance. The 0.86 level above is significant resistance, as we have seen it offer both support and resistance recently, and the weekly candlestick even tried to reach above there but failed. Just below, at the 0.8450 level, there seems to be a significant amount of support. If we can break out of this little range, it’s likely that the market will make a much bigger move.

If the market were to break above the 0.86 level, then the market could go looking towards the 0.87 level, or perhaps even higher than that. Having said that, if the market were to break down below the 0.8450 level, it’s likely that it could go down to the 0.8350 level after that.

Keep in mind that this is going to react drastically to how the situation turns out between the British and the Europeans, which should be paid attention to. Even for those that don’t trade this currency pair, this market should be one that traders pay attention to. That’s because it gives an idea of who is winning the conversation, and therefore traders can look to that stock market to trade as an example.

Looking forward in this market

Looking at this market, it’s obvious that we are getting ready to make some type of longer-term decision. If the asset can break out of this area, then it’s a simple matter of trying to pick up 100 pips on that move, or perhaps even further if things truly break out in an impulsive way.

This will probably be a very difficult year to trade both the euro and the pound. That said, this is a market in which traders will need to show a certain amount of patience, as it will offer an opportunity to make significant profits once the dust settles from this range. Keep an eye on this chart, as it will lead the way for so many other markets.