Euro Bounce to Offer Selling Opportunity

- Euro initially fell on Wednesday, only to turn around

- Currency bouncing against both US and Canadian dollar

- Euro still in major downtrend after recently making fresh lows

The euro initially fell during the trading session on Wednesday, but turned around about halfway through to show signs of life again. At this point, the market has shown signs new of life near the 1.09 level, but the market is in a major downtrend and has been so for at least 18 months. This isn’t to say it’s been easy to make money shorting the euro the entire time, but if you had sold this pair eighteen months ago and simply held on, you would be profitable.

Euro bounces against North America

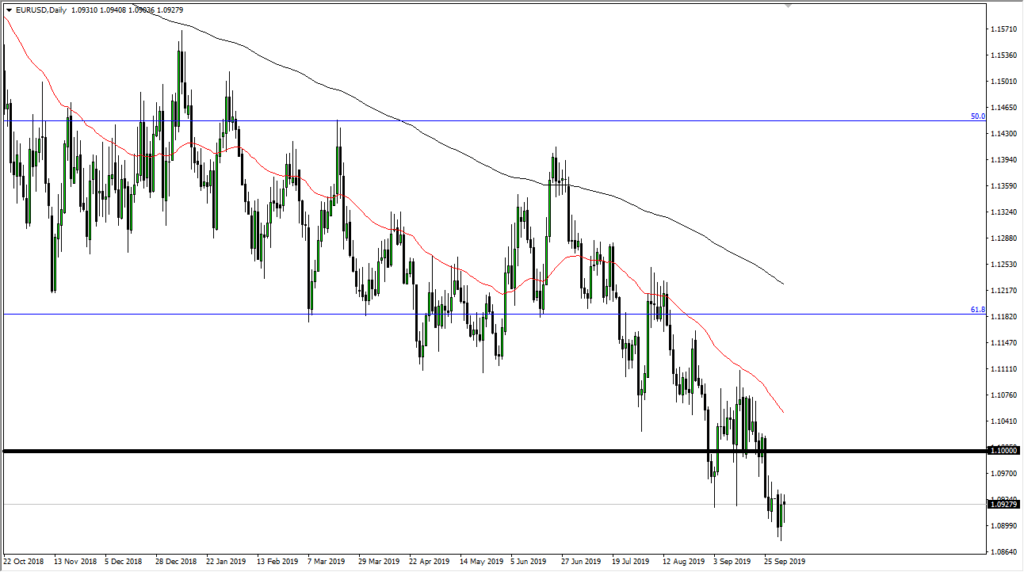

EUR/USD daily

The euro has bounced a bit against both the US and the Canadian dollar during Wednesday’s trading session. However, it is in extreme lows against both of those currencies, and therefore rallies should not yet be trusted. Both the US and the Canadian economy are much stronger than the European Union’s, as they are highly interconnected while supporting each other. On the other hand, the European Union is slipping into recession, with Germany teetering. In that scenario, it makes quite a bit of sense to see the euro fall against the greenback and the loonie.

All that being said, there is an enormous amount of weight in the market to the downside. The most common metric of a currency is how it is doing against the US dollar, and the move has been rather choppy yet steadily negative over the last several months. Above, the 1.10 level could cause a significant amount of psychological resistance as well. Beyond that, both Thursday and Friday of last week formed inverted hammers, which suggests that we may not even get to that psychological figure.

The trade going forward

The trade going forward is quite simple. Every time this market rallies, it offers an opportunity to pick up the US dollar “on the cheap”. The same can be said for the Canadian dollar, but this is also at the mercy of the crude oil market, which has been rather volatile. Because of this, paying attention to the EUR/USD pair makes more sense. All things being equal, the 50-day EMA above should continue to offer dynamic resistance, and it is racing down towards the 1.10 level.

The market should continue to be very choppy in general, but a move above that 200-day EMA would suggest a potential trend change, which could be much more vigorous than the action we’ve seen so far.