NZD/SGD to Face Significant Resistance

- New Zealand dollar risk appetite waning

- Singapore dollar a safety currency

- Longer-term downtrend

- Exhaustive candle

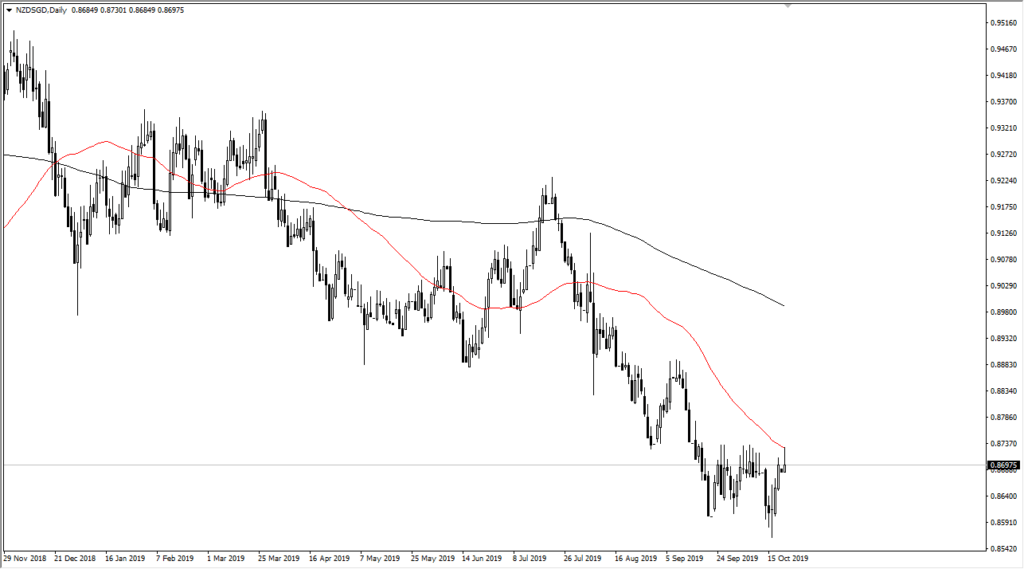

The New Zealand dollar rallied a bit during the early part of Monday, showing signs of exhaustion at the 0.8740 level yet again. This is a market that has been in a downtrend for some time, and the fact that the market is starting to show signs of exhaustion suggests that the longer-term trend should continue. Ultimately, the market could go down to the 0.86 handle underneath, which is going to be a large, round, psychologically significant figure.

A break above the 0.8740 level could send this market to much higher levels, perhaps to the 0.8880 level. However, that goes against the overall trend, and we do see a lot of wicks reaching above. If that’s going to be played upon, it should show quite a bit of exhaustion just waiting to happen.

All things being equal, the market should continue to find reasons to sell off not only from a technical standpoint, but also because of the fact that the world is a little less likely to take risks right now. After all, the New Zealand dollar is very sensitive to what’s going on in Asia, and the US-China trade relations continue to sour longer-term.

Technical analysis

NZD/SGD chart

While the market has tried to rally several times, the 50-day EMA has come into the picture on Monday and repelled buying yet again. This should continue to send this market lower, perhaps reaching to the bottom of the consolidation area that we have been in. All things being equal, this is a market that is going to continue to focus on the trade relations between the Americans and the Chinese.

With that in mind, it looks like rallies will continue to be sold into, and therefore buying is all but impossible. If the 50-day EMA does get broken to the upside, 0.880 as the most recent high above here should also bring in a lot of fresh selling pressure. The one thing that the market continues to focus on is slowing global demand. As New Zealand’s currency is very sensitive to global growth, being a commodity-exporting economy, it looks likely to continue softening.

Selling the rallies continues to work on short-term charts, recognizing that this pair doesn’t tend to be very impulsive and appears to be more of a grinding currency pair. Ultimately, though, this is the market that you will need to be patient with to accept all of your potential trading gains. This is not a market that gets scalped very often, simply because of the slow and steady pace of most trading sessions. However, all things being equal, the market should continue to reach towards the lows that were made recently.