Ripple showing signs of building up inertia

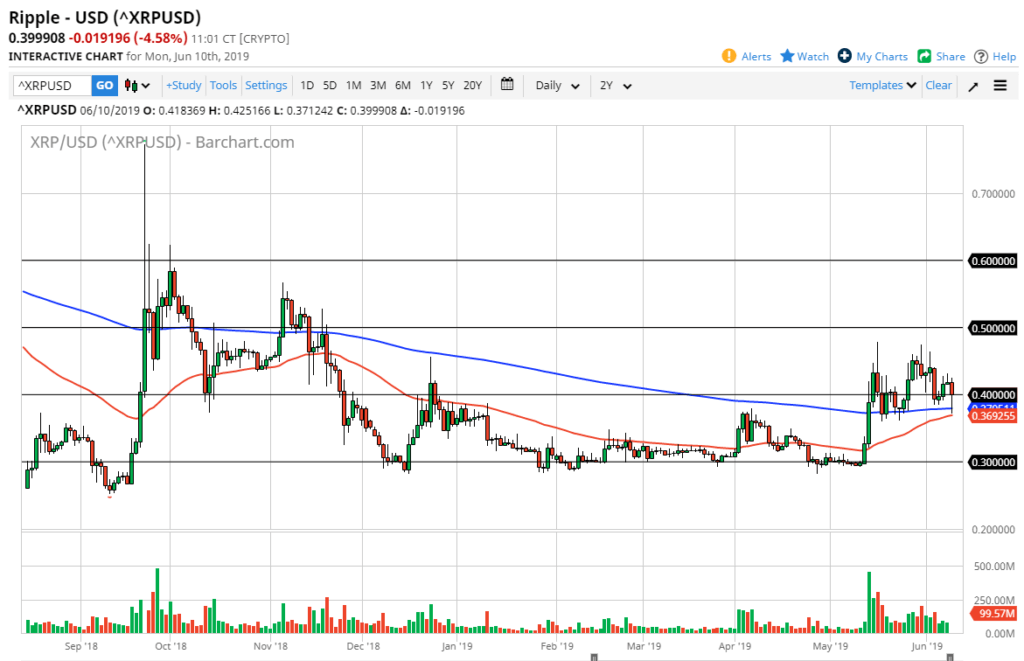

Ripple initially drifted lower during the trading session on Monday, reaching down towards the 200 and the 50 day EMA indicators on the chart. By pulling back the way we have and then bouncing, we are starting to form a bit of a hammer, which of course is a very bullish sign. At this point in time it’s likely that the buyers are starting to step in and try to take advantage of the obvious support level.

Moving averages

Moving averages sitting just below will continue to offer support, as the 200 day EMA is flattening out and more importantly the 50 day EMA is starting to turn to the upside. The $0.40 level seems to be showing signs of support as well, so at this point it looks very likely that we are ready to try to build up enough inertia to break out to the upside. The nice thing about Ripple is that we have a couple of moving averages sitting in this area, plus it does tend to move back and forth between $0.10 levels.

XRP/USD

Longer-term likelihood of a rally

Not to beat a dead horse, but quite frankly as Bitcoin goes, so does the rest of the crypto market. Ripple of course will follow right along as the rest of the crypto market does. At this point, the market looks very likely to continue to go higher as Bitcoin looks very strong. At this point, even if we break down below the red EMA, the 50 day EMA, it’s likely that we could test the $0.30 level underneath. That should be the “floor” in this market, and as cheap as Ripple is, it could be very easy to build up a large position to hang onto for the longer-term.

Beyond that, there is everything on this chart pointing to one conclusion from what I see: a move towards the $0.50 level above. That is resistance, but if we can break above there on a daily close, then we could go to the $0.60 level after that.

The main take away

The main take away here is that Ripple is very likely to continue to be bullish. Crypto in general has been seeing new money flow into it, so it makes sense that we should continue to see buyers on these dips as it offers plenty of value. Ripple needs to play a bit of catch-up when it comes to the Bitcoin push higher, as well as many of the other major crypto markets.

Another thing that is helping this market is the fact that the US dollar is rolling over suggests that other currencies, including Ripple, should continue to rally against the greenback as the Federal Reserve is stepping away from its tightening policy. That will have people looking to put money into other assets and away from the US dollar overall. Remember, this is just like a Forex pair, you are trading one currency against another, something that far too many crypto traders ignore.