US dollar continues to grind higher against Canadian dollar

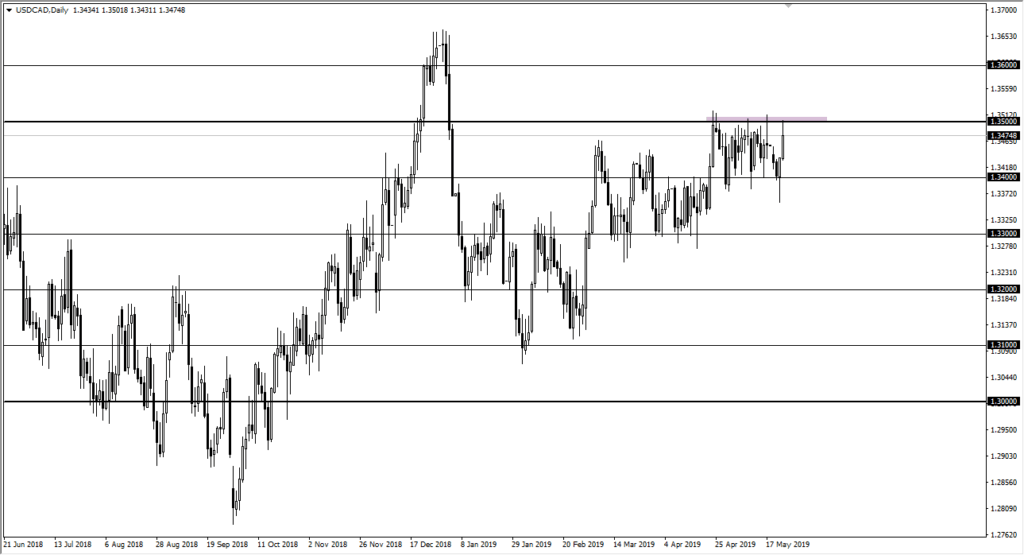

The US dollar rallied significantly during the trading session on Thursday, reaching towards the 1.35 handle. That being the case, the market has pulled back a bit from there, which has been an area that has seen massive resistance more than once, so it’s not a huge surprise that we have pulled back from there. Beyond that, keep in mind that the Canadian dollar is highly levered to the crude oil markets, and of course they made plenty of headlines during the trading session as well.

The importance of 1.35

The US dollar rallied rather significantly and slammed into the 1.35 handle, and as you can see that’s an area that has been important more than once. With that in mind it’s not really that difficult to imagine that a lot of profit taking was taken at that point. Now the question becomes whether or not we can break through there? I think that if crude oil continues to fall the way it did on Thursday, it’s very likely that the market will break above the level and continue to go higher. I think at this point; the market more than likely will go looking towards 1.36 level after that.

However, it’s just as likely that we pull back a bit and reach back towards the 1.34 handle. That is an area that has been massive support and as you can see on the chart you can clearly make out 100 point ranges that continue to cause reactions in both direction. Keep in mind that the US dollar is a bit of a safety currency as well, and the way that we have seen treasury markets break to the upside, it doesn’t make a huge surprise to most traders that we have gone higher against the Canadian dollar.

USD/CAD Chart

Crude oil

The crude oil market broke through a major uptrend line, and it suggests that we are going to go much lower. If that’s going to be the case then it’s very likely that short-term pullbacks will continue to attract buyers in this market. That being said, the 1.36 level would be the initial target, but I think at that point we would probably go much higher than that over the longer-term. This will be especially true if crude oil finds itself going below the $50 of barrel level.

That being the case, you should also keep in mind that if you are playing the Canadian dollar, you need to be aware of the housing bubble in Canada being popped as we speak. Quite frankly, with the Chinese buying as much is a candid places like Toronto and Vancouver, housing costs have gotten out of control for the locals, and that keeps the Canadian dollar on the back foot of it.

The main take away

The main take away is that this market has been moving in a 100 point ranges for some time, and at this point it’s likely that the market would continue to see back-and-forth action in these ranges. It is a short-term trading opportunity just waiting to happen, so therefore look for short-term pullbacks to take advantage of.