AUD/CAD: ready to rip higher?

The Australian dollar has been falling against the Canadian dollar over the last couple of months, but we have finally entered an area that could attract a lot of buying pressure. This makes sense, because the Australian dollar is at an area of major support against the USD, which of course is the barometer of a currency strength in the Forex world anyway.

With that being said, let’s take a look at some of the reasons that we could see strength in this pair, from both a fundamental and a technical standpoint, it looks as if the stars are aligning for the buyers.

Fundamental/political reasoning

The latest Canadian inflation numbers have been rather soft, so for that reasoning alone there is a little bit of a negative bias when it comes to the Canadian dollar. Beyond that, we also have the US/China trade relations discussions going on, it looks as if we are probably going to at the very least get some type of delay to the tariffs, and that should be good for the Australian dollar as it is a bit of a proxy for China.

Remember, the Australian supply China with most of their hard materials, such as copper and iron. Because of this, if the Chinese economy or economic situation is doing well, that typically reflects itself in the value of the Australian dollar. As for the Canadian dollar, the lower inflation numbers and the possibility of a caught to the interest rate in the future has the Loonie looking a bit soft. However on the other side of the equation we do have the crude oil markets that could drive up demand for the Canadian dollar. Because of this, I think it may soften some of the impulsive move to the upside unless of course we get an actual deal between the Americans and Chinese, which would trump everything else and send this market much higher.

Technical set up

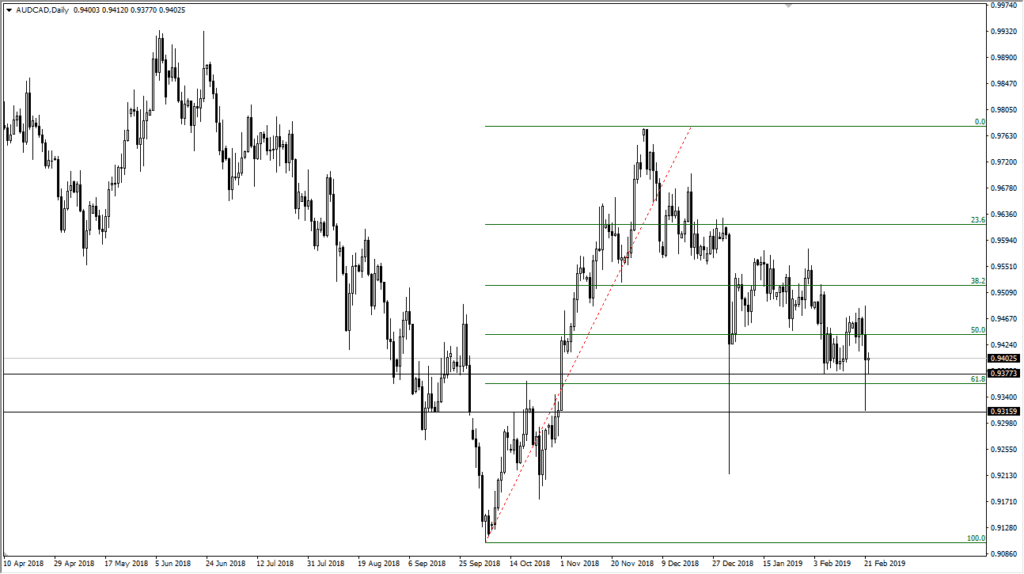

The technical set up is that we are sitting at an area that has previously been support, and of course we are sitting at the 61.8% Fibonacci retracement level. That’s obviously a very good sign, and at this point I do believe that the market is likely to respect that level as it has been an area of significant strength in the past anyway. Beyond that, looking at the daily candle stick from Thursday, you can see that there was a lot of buying pressure underneath. As we roll into the Friday session, we are seeing a bit of stability, which is the beginning of the market trying to rally. I believe at this point we are waiting for some type of news coming out of Washington DC with the Americans and the Chinese, to give us the “all clear” as far as buying the Aussie is concerned.

With all of those things coming together, it makes a lot of sense that the buyers are sitting underneath and trying to take advantage. However, the noise probably will continue to be deafening, so keep that in mind. With that, we also have the weekend coming that will almost certainly give us some type of headline to react to in the morning on Monday.

The take away

At this point, it’s very likely that the risk is to the upside and not the down, as we have so much of a large cluster of support just below the 0.93 handle, which of course has us with a slightly large stop loss, but nothing that can’t be worked around with proper money management. To the upside, we could revisit the 0.7975 handle which would be a complete move from the retracement that you would expect as a Fibonacci trader.

The only way this market melts down more than likely is if something comes out that pretty much kills the idea of some kind of resolution between the Americans and the Chinese, something that seems very unlikely at this point as both countries are starting to feel the pain of this trade war.