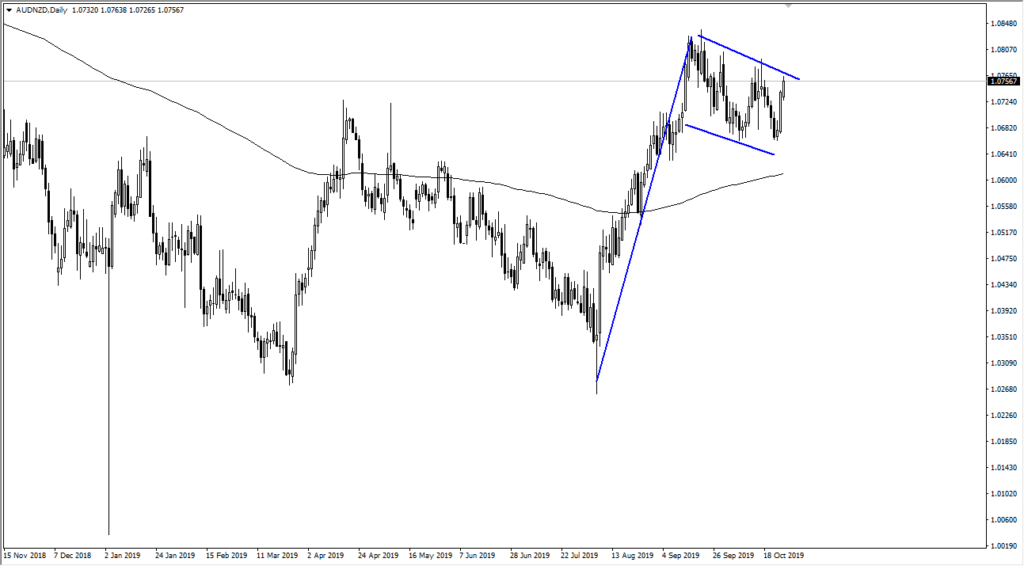

Aussie to Continue Strengthening Against Kiwi

- Australian dollar forming bullish flag against Kiwi

- Longer-term uptrend

- Both currencies sensitive to Asia

The Australian dollar has rallied a bit during the day on Monday to kick off the week, showing signs of strength yet again. Looking at this chart, it’s obvious that it has been in an uptrend and therefore likely to continue to go higher.

The bullish flag is a very popular pattern that a lot of trend traders will follow. The market is very close to kicking off the top of the pattern, meaning it would be a sign that longer-term traders would get involved and start buying.

Sensitivity to Asia

Sensitivity to Asia is a common theme between both economies. The Australians export raw materials such as copper, iron, aluminum, and other such hard commodities to the Chinese, while the New Zealand economy is based more on agricultural exports such as milk and meat. The one thing they both agree on is that their largest customer is China.

Looking at the US-China trade war and the economic figures coming out of mainland China, it certainly is starting to weigh upon the growth situation. At this point, the market is decidedly shifting towards harder commodities firming up, perhaps due to the fact that Australia has so much gold it can export. Gold has done fairly well, so that might be one of the main difference makers.

Technical analysis

AUD/NZD chart

The technical analysis is relatively obvious. The market is at the top of the bullish flag, and above the 1.08 level it will have kicked that pattern off to get more buying going. The pole of the flag measures for a potential move of 600 points, meaning we could be looking at a move to the 1.14 handle. This doesn’t mean it will get there right away, but clearly it would simply be a continuation of what we have seen so far.

What’s even more interesting is that the 200-day EMA is sitting just below the body of the flag, and therefore longer-term trend traders will be paying attention to that as well.

The Australian dollar has been somewhat lackluster against most other currencies, but it should be noted that the New Zealand dollar has been pummeled against those same currencies. It’s a relative strength play as most currency trades are, and relative strength most certainly favors the Australian dollar.

The trade going forward

On a move above the 1.08 level, it’s time to start buying this pair for a longer-term move. It would make sense to see a certain amount of resistance near the 1.09 handle, but that should simply be a blip on the radar, so to speak. Hanging on until the 1.14 level makes the most sense, but if the market was to turn around and break down below the 1.0650 level, it would destroy the pattern and throw everything into disarray.

That being said, this is a marker that looks very bullish, and it does, in fact, look like it is trying to build up significant momentum to continue rallying.