British Pound Continues Moving Higher

- The British pound continues to rally on Monday

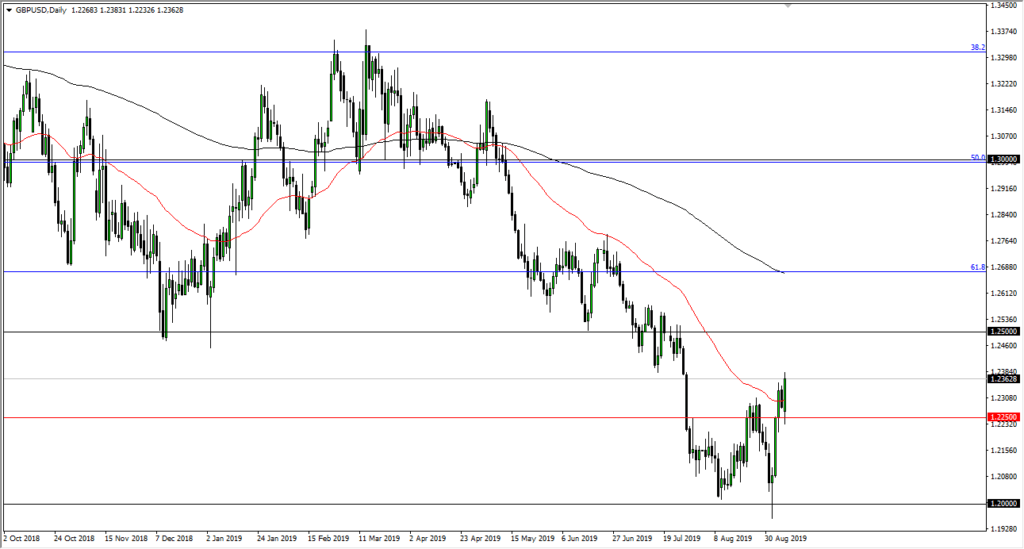

- Clears 50-day EMA

- Reaching towards psychologically important 1.25 GBP level

The British pound has rallied during the trading session on Monday to kick off the trading week, slicing through the 50-day EMA yet again. This is a positive development, as traders continue to try and figure out what’s going on with Brexit this week. Currently, it looks as if Boris Johnson has been stymied a bit. But at the end of the day, even if Brexit gets delayed, there is going to be one underlying factor in this pair: uncertainty.

GBP/USD daily chart

Technical analysis

The technical analysis is short-term bullish, longer-term bearish. The 50-day EMA being sliced through, as we have seen earlier on Monday, is a good sign. However, there is still a significant amount of resistance near the 1.25 handle above, as it is an area that looks to be very congested. It has a certain amount of psychological significance to it, due to the fact that it is a large, round, psychologically significant 500-point number. Quite often, you will see large orders at these levels. Beyond that, you can also see that it had zigzagged quite a bit last time it was there, which shows a lot of energy being absorbed by the market.

The 200-day EMA is currently at the 1.2680 level and racing towards the 1.25 level. As such, it’s likely that we will continue to see a lot of interest in the market, as it is the most news-driven pair right now. Everything indicates that longer-term money is simply waiting for an opportunity to sell at higher levels.

The trade going forward

The trade going forward is going to be one that takes some patience. Simply waiting for a move towards the 1.25 level seems to be the most prudent thing right now, because the situation with Brexit is still so fluid. At this point, there is still a fair amount of uncertainty out there that could continue to plague this market. There is plenty of reason to think that the volatility will only get worse, especially as we start to get close to the October 31 deadline. Ultimately, waiting for signs of exhaustion above will be the way to play this market. It’s also worth nothing that the 1.20 level has offered significant support while the market was a bit overextended at that point in time.

Wait for exhaustion candles, and then go with the longer-term trade, which has obviously been very negative. There will probably be one more massive “flush lower” once Brexit gets settled. At that point, it’s very likely that value hunters will come in to pick up the currency after some stabilization. Until then, the trend is still very much negative, even though the last couple of trading sessions have been quite the contrary.