British pound recovers ahead of jobs figure

The British pound has fallen early during trading on Thursday but turned around to show signs of recovery by the time the Americans took over. At this point, it looks very likely that the market will continue to go back and forth, and therefore I think that the market is simply waiting for the jobs figure to come out at 8:30 AM Eastern Standard Time in America. That will be the next driver of the US dollar, as so much had happened during the Wednesday session due to the Federal Reserve.

Federal Reserve

To me, it’s quite obvious that the market didn’t get what it wanted out of the Federal Reserve. The US dollar strengthened quite a bit during the trading session on Wednesday, as perhaps some had anticipated 50 basis point rate cuts, or at least signs that we were going to continue to see further cuts going forward.

Ultimately, this is a market that has turned right back around but at this point it’s likely that we are going to turn things back around to get ahead of the jobs announcement. The jobs announcement of course will have a great influence on where we are going to next, as strong jobs numbers may have people worried about whether or not the Federal Reserve will come again. Ultimately though, this is only part of the equation as you probably know by now.

Brexit

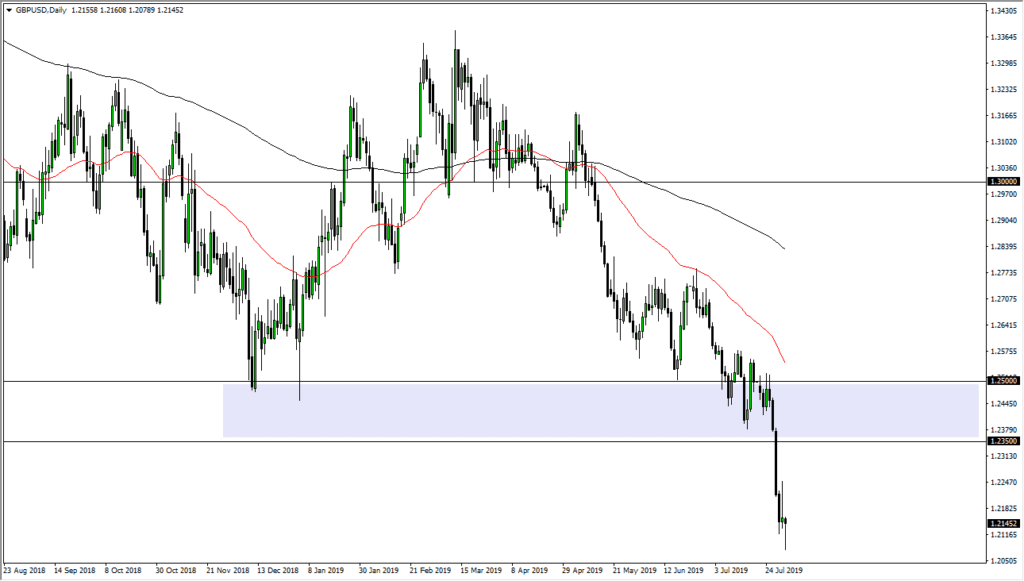

The biggest problem that we have here is of course the Brexit, which is still up in the air. At this point in time there doesn’t seem to be any clear directionality at this point except for perhaps the idea that we may have a “no deal Brexit.” That is starting to become more of a likely scenario and that will of course weigh upon the British pound. At this point we are getting close to the 100% Fibonacci retracement level, and I do think that we will probably go looking towards 1.20 level.

The trade going forward

GBP/USD

The trade going forward is rather simple for me. The question is whether or not we bounce before I start selling. If we rally from here, I suspect that the 1.2250 level should be resistance, just as the 1.2350 level should offer selling pressure as well. The alternate scenario of course is that we break down below the hammer that formed during the trading session on Thursday. Either way, there’s no way to start buying this currency, at least not at this point. Granted, someday this will be the “deal of a lifetime”, but we are far from that.

I am looking for signs of exhaustion after a rally, and I do prefer selling at higher levels if I get that opportunity. However, if we break down below the hammer than it is a trade that I have to take as well. I suspect we will be able to buy the British pound after the October 31 deadline, but between now and then we still have further downside to go.