Chinese yuan rallies after US delays tariffs

The USD/CNH pair has attracted a lot of attention recently as the US/China trade relations have soured. However, during the trading session on Tuesday we started to see the United States suggests that they were going to delay some of the tariffs that are coming on September 1 in order to give telephone talks between the countries of the next couple of weeks a chance to work. With that, we started to see the Chinese yuan pick up a bit of strength as it is now anticipated that the Peoples Bank of China will try to fix the rate at lower levels.

Tariffs

USD/CNH

The tariffs that the Americans have levied on the Chinese have been causing quite a bit of trouble, and this has been a bit of an issue not only from the export side of things, but most debt issued in China is denominated in US dollars. Quite frankly, this currency pair was getting to be a major problem. Now that we have drifted a bit, that should have a bit of a soothing effect on not only this currency pair, but perhaps the Shanghai Exchange.

Ultimately though, it should be noted that we are simply seeing hope show itself in the market, not any actual concrete plans or decisions. With that in mind it’s hard to imagine that this move will stick, and this could end up being a buying opportunity as there are a multitude of issues out there that should continue to favor the greenback as far as a safety currency. Beyond that, we have seen this movie before and it ends up with the US and China becoming even more entrenched in their positions.

Major figure

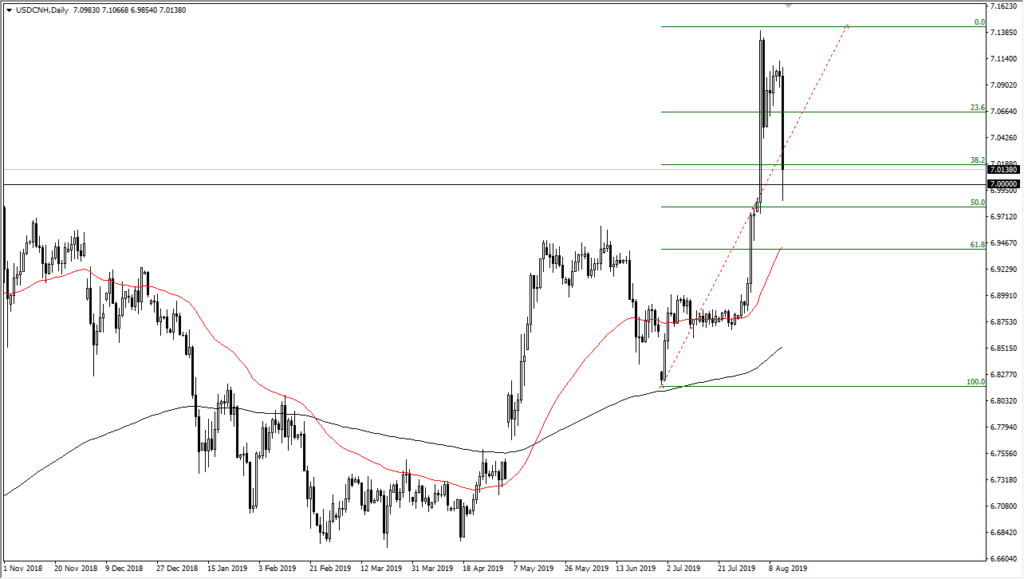

The 7.00 level of course is a major round figure, showing signs of interest by institutional traders, as we have not only pull back but we also have bounced just a bit to show signs of life. The 7.00 level is an area that attracts a lot of attention not only in the past but also right now. Ultimately, another thing that is catching my attention is that the 50% Fibonacci retracement level is just below the 7.00 CNH level, and therefore it’s very likely that this should attract buyers.

The trade going forward

The trade going forward is to simply pick up the US dollar as it pulls back a bit. I believe there is a significant amount of support not only at current levels, but also all the way down to the 61.8% Fibonacci retracement level, which is just below the 6.94 CNH level. I believe that it’s only a matter of time before the United States and China start bickering again, and that should only drive this currency pair higher. That being said, if we were to break down below the 6.88 CNH level, then we probably break down even further. My base case scenario is to look for short-term pullbacks in order to take advantage of value in the greenback.