Crude Oil Price Surges as U.S. Plans to Halt Sanction Waivers

Crude oil prices reached a six-month high on Monday. This comes as the Trump administration looks set to announce the end of sanction waivers to any country importing Iranian oil. This would mean all imports from Iran would end, or the nations leave themselves subject to U.S. sanctions. Eight nations who currently hold waivers are set to be impacted.

A Bullish Push on an Already Pressured Market

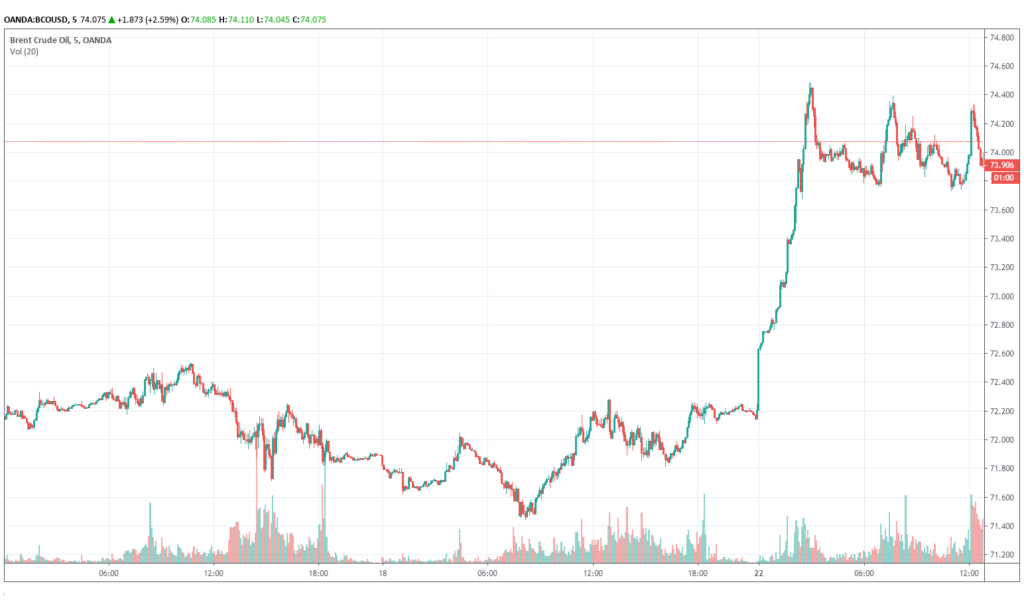

Brent crude futures were trading up as much as 3%, at $73.87 early on Monday. This has already surpassed the previous 2019 high, and reached the highest levels since November 2018. WTI futures were also up more than 2% at a high of $65.52, a mark which has also not been seen since October 2018.

The spike in price comes, as the move not to renew sanction waivers will cause a reduction in supply available to the market. Traders have responded with strong buying levels in anticipation of the supply restriction.

Crude Oil Chart – April 22nd

Restrictions to Take Full Effect from May 2nd

Reports in the Washington Post, that the Secretary of State, Mike Pompeo, would announce the cessation of these sanction waivers from May 2nd. The report cited two, unnamed State Department officials. The intended impact of the move is to place a complete stranglehold on Iranian revenue from oil exports.

A U.S. oil prices increase, follows on from an already strong drive to start the year. Crude prices are already flying at +44% on the year to date. This follows the late 2018 collapse in price. Stronger demand may also have been influenced recently by the release of more positive than expected first-quarter GDP figures from China. These exceeded global expectations at 6.4%.

A Good Time to Turn the Screw?

The administration may see this as the ideal time to apply extra pressure on Iran. This is given the recovery of the oil prices from where they were 6 months previously, when the sanctions waivers were granted. China, India, Japan, South Korea, Italy, Greece, Turkey and Taiwan are all currently in receipt of a waiver. This means they will all need to find an alternate source for their oil demands.

Positive correlation between oil price and the stock market, also means that the equities market has seen a small boost on this news. This could be viewed as a short-term positive by the government, although particularly the Trump administration is well-known to favor keeping the oil price as low as possible. They typically do not like to see a price above $60 per barrel.

The delicate balancing act which the U.S. is trying to achieve, of keeping the markets in a positive position, while freezing out Iran, and simultaneously retaining an affordable oil price, will all depend on the ability of Saudi Arabia to cover the approximately 1 million barrels per day which will be taken off the market. Trump may also be hoping that some of this gap can be plugged by increasing American oil exports. This however, is likely to only cover a small portion.