Ethereum continues to consolidate

When you weren’t looking, Ethereum has rallied right along with Bitcoin. Remember, although Bitcoin is the “big dog” when it comes to the crypto currency world, there are plenty of other markets that you should be paying attention to. As a general rule, Bitcoin moves first and everybody else follows. This of course is no different with Ethereum, which has enjoyed a nice rally recently.

Currently consolidating

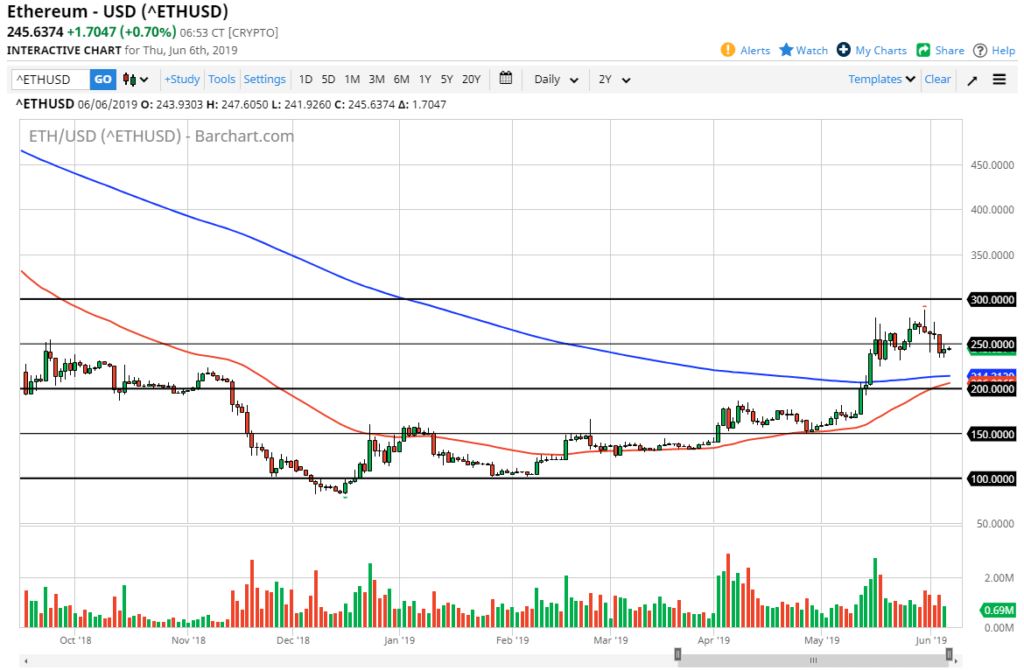

Ethereum is currently consolidating around the psychologically and structurally important $250 level. This of course will attract a lot of attention, just as the $300 level above has attracted a lot of trading pressure. It makes sense that we couldn’t break directly above the $300 level right away, because quite frankly that is such a large and significant figure. However, when you see a market pull back like this in an uptrend and go sideways, quite frankly what you are watching is inertia being built up. If that’s indeed what’s happening, we could be ready to make a move rather soon.

Moving averages

ETH/USD

I have a couple of moving averages marked on the chart, with the red moving average being the 50 day EMA, whilst the blue moving average is the 200 day EMA. As we are getting ready to see the so-called “golden cross”, the scenario where the 50 day EMA crosses above the 200 day EMA, there will be longer-term traders looking to get involved as that is typically a “buy-and-hold” signal. When it comes to trading these moving average is, think big money.

Beyond that, the 200 day EMA should offer support by itself. Either way, Ethereum looks very well supported just above the $200 level. Not only do we have the moving averages, but back in November 2018 we had a lot of trading action in that general vicinity, roughly at $210 or so.

As with most crypto markets, buying the dips continues to work

As with most crypto markets, buying the dips continues to work in Ethereum. At this point I would have to assume that the $200 level is essentially the “floor” in the market, and it isn’t until we break down below that level that I would have to rethink some things. In the short term though, it’s obvious that every time we did, there are value hunters willing to step in and buy this market.

The real test is going to be whether or not we can break above the $300 level. If Bitcoin continues to perform the way it has, it is probably only a matter of time before Ethereum breaks out above that level and continues to go higher. As you can see on the chart, it does tend to react every $50 handle, so obviously the next barrier would be $350, followed by $400, etc.

Beyond that, we have a lot of volatility in the mainstream financial markets, and that always tends to help crypto as it is a place that isn’t as highly correlated to so many other assets. With that in mind, Ethereum looks strong.