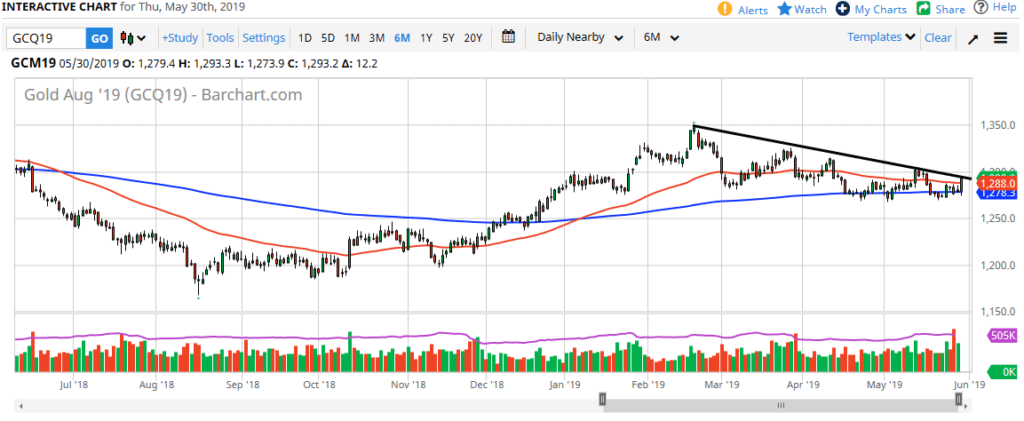

Gold markets test major trendline

Gold markets rallied during the trading session on Thursday, reaching towards the downtrend line that I am clearly marked on the chart. I believe that the $1300 level will continues offer resistance as well, so although we have seen a very positive candlesticks for the trading session, it’s likely that we are going to run into trouble in this general vicinity.

Still driven by the dollar

The goal market still driven by the US dollar overall, as the rising US dollar will quite often worked against gold, while a falling US dollar will typically lift gold. A lot of this comes down to risk appetite as well, so pay attention to what’s going on there. All things being equal, I think at the first signs of exhaustion we will probably see sellers come in and push this market back down towards the $1270 level.

A couple of levels were paying attention to

gold

There are a couple of levels to pay attention to, with the previously mentioned $1270 level as massive support. If we turn around and break down that area, gold is certainly going to struggle at that point. To the upside, I suspect that the downtrend line and of course the all-important $1300 level will offer resistance above. At this point, I think that dancing between these two areas will offer short-term trading opportunities, but I think that those two levels are much more important than anything else. If we can break above the $1300 level, then I think longer-term money will come in and try to reach towards the $1350 level, perhaps even the $1325 level. On the other hand, if we break down below the $1270 level, the market probably reaches to the $1250 level, and then possibly the 1000 hundred dollars level given enough time.

The main take away

I believe that at this point it’s likely to be very choppy in general and stay in the short term range, mainly because the market will have a lot of things to pay attention to. Beyond that, think about the overall risk appetite when it comes to the US/China trade situation. If that’s going to be as difficult as it has been recently, then I think the gold market will probably continue to be just difficult.

Expect short-term trading, perhaps back and forth on short-term charts to trade this market. However, once we break out one of these major levels then you can search for much more significant position size and confidence into your trades. This market has been drifting lower for some time, but obviously has significant rather significant support. Something has to give, and it’s going to do so soon. Once it does, we should have much more clarity to put things together. Gold markets continue to see a lot of trouble based upon simple confusion. Nobody knows what’s going to come out of the markets these days, and therefore risk appetite is a little place. That will probably be a nuisance for the rest of summer