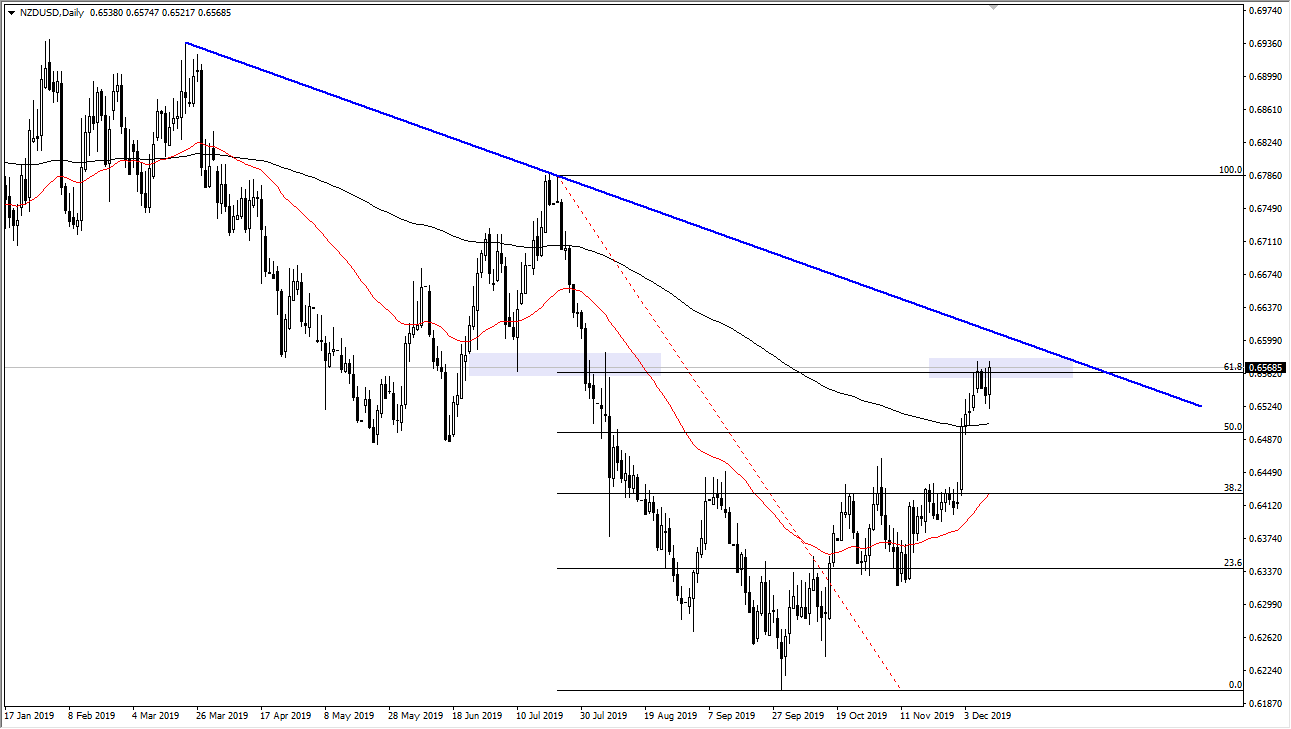

New Zealand Dollar Facing Major Test Just Above

- 8% Fibonacci retracement level

- Major downtrend line

- 200 day EMA underneath

The New Zealand dollar initially pulled back during the trading session on Wednesday but then turned around to show signs of strength. It had broken above the 0.6575 level I point, but this is an area that has shown a bit of resistance previously. At this point, the New Zealand dollar is heading towards a major confluence of resistance and could start to show that a trend change could be imminent.

New Zealand Dollar Technical analysis

NZD/USD chart

The Technical analysis had initially pulled back during the trading session on Wednesday but has turned around to show signs of strength again as the market awaits the FOMC. It’s probably going to be a “nonevent”, as the Federal Reserve doesn’t have any real reason to do anything crucial, and the market is likely focusing more on risk appetite.

The 61.8% Fibonacci retracement level is sitting just above, and that is an area that will attract a lot of attention as traders look at it as potential resistance. However, the 200 day EMA is sitting just below and crawling higher, and the 50 day EMA is starting to go a bit parabolic, showing signs of strength. If it can move above the downtrend line sitting near the 0.66 handle, the New Zealand dollar will break trend and continue to go much higher.

External pressures

There are plenty of external pressures when it comes to the New Zealand dollar as its movements are so highly tied to the Chinese mainland. Commodity markets, in general, will continue to be driven by risk appetite. As a result, the US/China trade situation will continue to be a major issue to pay attention to. The December 15 deadline is coming this Sunday, and it is possible that Pres. Trump levees tariffs again.

The trade going forward

The trade going forward is relatively straightforward, a break above the 0.66 level should send the New Zealand dollar higher and change the trend once and for all. Some traders will look at the fact that the market is above the 200 day EMA as reason enough to go long. So this will be more or less the “final nail in the coffin” when it comes to the trend change. Just below, the 0.65 level should offer support, just as the 200 day EMA which is painted in black on the chart will. If it were to break down below the 0.6450 level, then it is likely that the market breaks down further. This would probably be due to a major “risk-off” issue. This is a market that is worth paying attention to between now and the beginning of next week as fireworks could be on the horizon.