New Zealand dollar rallies against yen on Wednesday

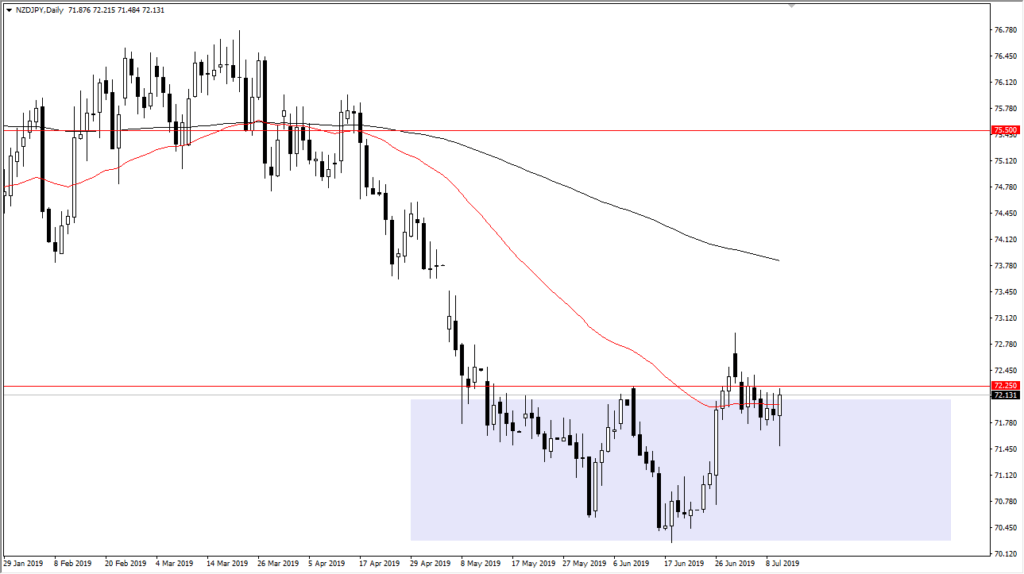

The New Zealand dollar initially fell during the trading session on Tuesday, dipping as low as ¥71.50 before turning around and rally. At this point, it looks as if there’s more of a “risk on” move coming into the marketplace, as we continue to test the ¥72.25 level. This perhaps is due to the statement coming out of the Federal Reserve in front of Congress suggesting that interest rate cuts are in fact coming, which in general is going to be good for risk appetite around the world.

Major resistance barrier

NZD/JPY

the New Zealand dollar has a lot of resistance built in between the ¥72.25 and the ¥72.50 level above. If we can clear that, then the market is very likely to continue going towards the ¥73 level, and then beyond. The fact that we turned around so decidedly during the trading session on Wednesday does in fact suggest that there is pressure building underneath to push this market higher. Given enough time, it looks very likely to finally break out. Traders are starting to get trapped in this resistance barrier, so breaking above it will have a lot of shorts looking to cover.

That will more than likely continue to push this market even higher, perhaps as high as the ¥74 level in the short term. Keep in mind that this is very risk sensitive, so this will all be predicated upon the idea of fresh liquidity being pumped into the marketplace by the Federal Reserve.

Asia

The Kiwi dollar is highly sensitive to all things Asia, especially China. If we can get good risk appetite showing up in Asia during the stock market hours, that could help lift this market as well. Obviously, the US/China trade relations could affect this market rather rapidly as well, so this is one of my favorite plays for all things Asia positive.

Technical pattern

You can make a bit of an argument for a bullish flag, so that’s another reason to think that we will continue to go higher. On that breakout, the measured move looks for the ¥74 level as well, so that’s no mistake that I suggest we could get there. Short-term pullbacks should be thought of as buying opportunities, as long as we can stay above the ¥71.45 level, which is the bottom of the candle stick for the trading session on Wednesday as I write this article.

The 50 day EMA of course has somewhat of an influence, but it’s flat so that tells us that the market is trying to turn things around after being so negative for so long. There may be bumps along the way, but that’s clearly it looks like a market that’s trying to turn around for a bigger move to the upside. That being said, if we were to break down below the bottom of the range for the day, that opens up the door to the ¥70.50 level, which has seen support in the past. Presently, I think that’s the least likely of scenarios.