New Zealand dollar to go lower against Canadian dollar

The New Zealand dollar has tried to rally again during the trading session on Tuesday but continues to find selling pressure against the Canadian dollar. This could be a function of the Asian economy slowing down, and of course the US/China trade war. Remember, New Zealand is an economy that is highly levered to Asia, so as long as there are troubles with the Asian economies, this will of course have a knock on effect over here in New Zealand.

Resistance above

NZD/CAD

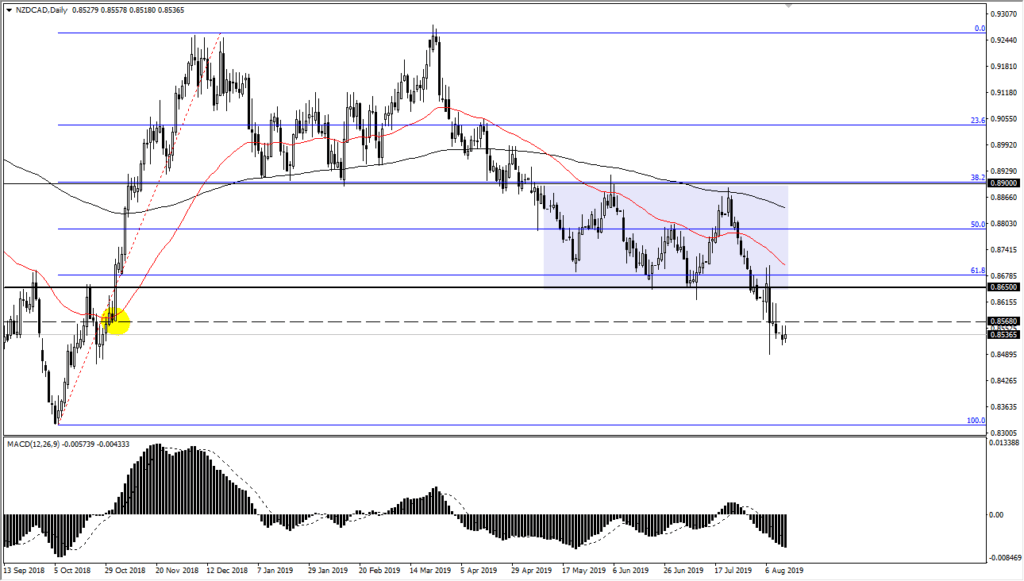

The market opened up the week gapping lower and has tried to rally a couple of times but as you can see over the last four daily candlesticks, we have sold off every time we have tried to rally. Because of this, I think that the extended negative candle from last week should eventually lead to lower pricing. I believe this makes quite a bit of sense as North America is somewhat insulated against the Asian situation, especially considering the Canada is highly levered to the US economy, which is one of the better performing economies in the world. In a sense, one of Canada’s biggest strengths is that it is right next door to the United States.

Because of the strength of the US, Canada will be preferred over New Zealand. Beyond that, the 0.8568 level seems to be somewhat resistive as well, and most certainly the 0.8650 level will be. With that, it’s not until we break above the latter of the two levels that I would consider buying this pair.

Targets

The targets below are multiple. I believe that the 0.85 level will obviously be a short-term target, as it is a large, round, psychologically significant figure. However, the market is much likelier to not only reach that level but drag below there as we have seen so much selling pressure. Ultimately, I think that we will probably go looking to wipe out the entire move, meaning that we could go down to the 100% Fibonacci retracement level. That is closer to the 0.8325 handle underneath.

One of the main reasons why I believe that we will make it to these lower levels is that we have taken out the explosive candle to the upside that really kicked off the major move higher back in October 2018. I have that circled in yellow, to show you how that level has been broken. That means everybody who had been involved in that move higher is now either losing money or out of the market.

How I will be trading

The main way I will be trading this market is to look for short-term rallies to start selling again. I believe that you can use short term charts the time your entry, but I still think that we can hang on to try to find a bigger move overall. That being said though, if we were to break above the candlesticks from last week that were breaking above the 0.8650 handle, then I could consider buying but obviously that would take a significant shift in attitude.