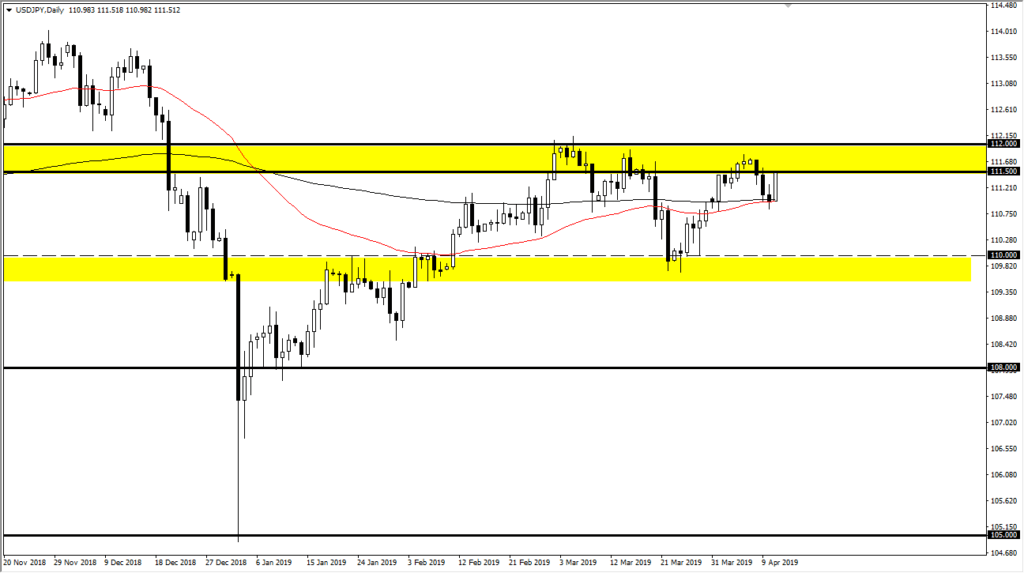

US dollar continues to press resistance against Japanese yen

The US dollar rallied significantly during the trading session against the Japanese yen, in what was mixed trading overall for the greenback. That being said, we are approaching a major resistance area in this chart so the upside is probably somewhat limited. With that being the case now, one would have to think that sellers are starting to come back into the fray, making an argument for a short sale.

Obvious levels

There are two major issues when it comes to trading obvious levels: the first one is keeping your position size reasonable. It’s very easy to over lever a position in these areas because you just “know it’s going to work out.” It’s normally on that trade that you see the unlikely happen. The other courses being patient enough for the trade to set up. If you can handle both of those situations, in general these types of set ups will be very profitable for you.

The obvious levels here are marked by the yellow box is on the chart. The ¥111.50 level is an area where you would expect to see significant resistance. It extends all the way to the ¥112 area, so there is an entire range of selling pressure just waiting to be had. With this in mind it’s probably going to make a lot of sense to look to short-term charts for signs of exhaustion to take advantage of.

USD/JPY daily

On the other side of the equation we have the ¥110 level which looks to be massive support. As long as we can stay above that level it’s likely that there will be some buying interest in this pair, and quite frankly I think to break down below that level would probably denote some type of major financial crisis brewing. Even if it’s not a major financial crisis, at the very least is probably going to coincide with the S&P 500 as this pair tends to do anyways, so therefore expect some type of meltdown in the S&P 500 if we do see this pair below that crucial level.

If we do break down below that level I anticipate that the ¥108 level would be your next target, which is massive support on the longer-term charts. All in all, I do like this pair for back and forth short-term range bound type of environment, at least until we can figure out where the stock markets are going overall. Until we do that though, it’s going to be very difficult to glean too much in the way of information in this market, as clearly we have seen a lot of back and forth.

Trade size matters

In an environment like this it’s crucial that you do not over levered the position, and that you take advantage of the range responsibly. If you do not, you can just about guarantee massive losses. However, once we break out of this range you should become much more aggressive as the market tends to move very quickly once breaking free of such well-defined ranges. Remember, half of the people in this consolidation area are going to be trapped after this breaks out.