US dollar struggles on Wednesday against Canadian dollar

The US dollar initially tried to rally against the Canadian dollar during the trading session on Wednesday, reaching towards the 1.33 handle. With that being the case, it looks as if we are struggling to rally from here above that level. It’s a level that has been important on shorter-term charts, as it is a “round number.” Beyond that though, it looks as if oil is trying to recover, and if that is going to be the case the Canadian dollar should show relative strength. Don’t get me wrong, the USD/CAD isn’t the purest of plays when it comes to crude oil but it certainly has a significant amount of influence.

Federal Reserve changes its tune

The Federal Reserve has recently changed its tune when it comes to monetary policy. They are now “open to the idea of loosening monetary policy”, something that they have not been willing to until now. That has people rethinking the entire monetary policy, and in fact the markets are pricing in rate cuts in just a few months. As a general rule, currency markets trying to lead the rest of the markets by a few months, so that’s part of what we are seeing here.

It isn’t so much that Canada is strong, it shows that perhaps the US dollar was overvalued, and we have seen that as of late. The impulsive selloff over the course of the previous week looks as if it is going to stick, so it makes sense that we continue to run into trouble.

Technical set up

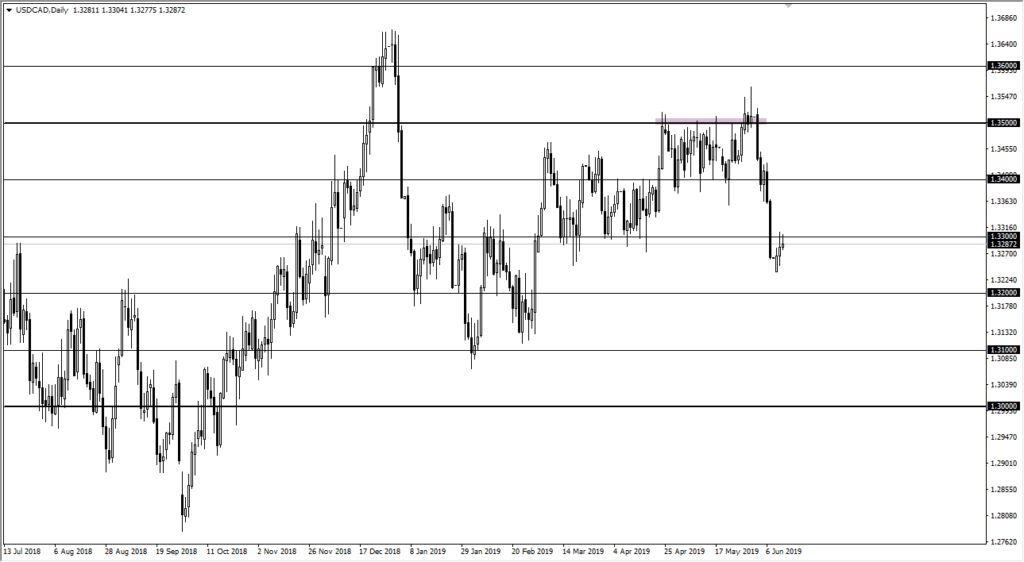

USD/CAD

At this point, it’s obvious that we have changed the overall attitude of the market. You can see that this pair clearly follows the 100 PIP range when it comes to back-and-forth. Overall, this is a market that looks likely to see the 1.33 level as continued resistance, so I think that a roll over towards the 1.3250 level followed by the 1.32 level makes quite a bit of sense. That being said, there is also the alternate scenario as per usual.

The alternate scenario would be that we break above the 1.33 handle which would be a significant break out, but not necessarily a trend changing break out. At that point, I would anticipate that the sellers would probably try to reassert their dominance closer towards the 1.34 handle. It wouldn’t take much to draw a trend line in that general vicinity, so it’s very likely that a lot of traders will be paying attention for various reasons.

At this point, it’s even possible that we go looking towards 1.31 handle, as it was the scene of a major break higher several months ago, and market memory dictates that we need to retest that area over the longer-term. Currently, it’s probably favorable to try to fade rallies, especially if the crude oil markets start to perk up again because that would be yet another reason for this market to favor the Loonie going forward.