WTI Crude Oil falls hard on Friday

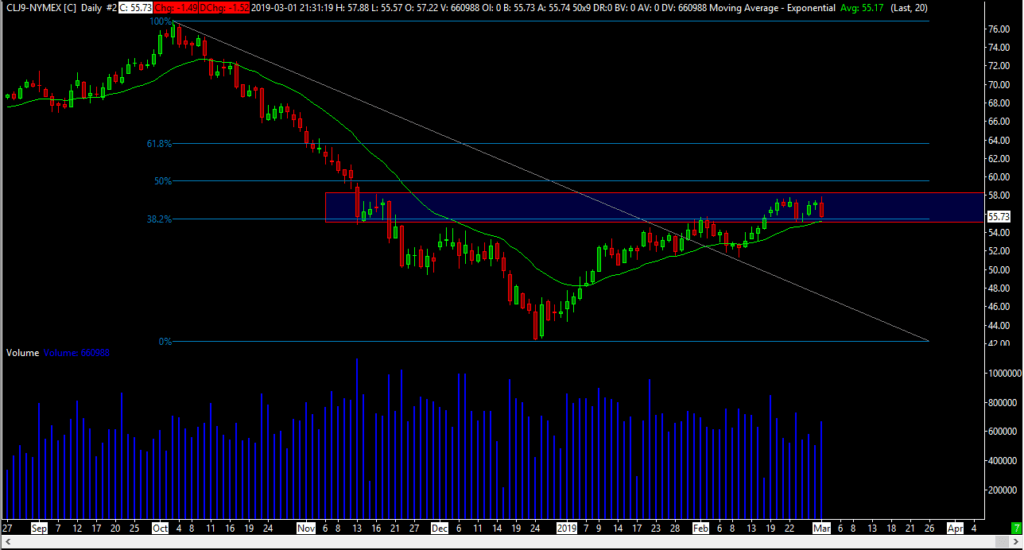

The WTI Crude Oil market fell rather hard during the day on Friday, after initially trying to reach towards the highs again. On the chart attached to this article, you can see that the entire area has been very interesting for traders in both directions. We have a blue rectangle suggesting where buyers and sellers continue to fight in this market. This area is crucial for the longer-term, so by all means you should be paying attention.

Crude oil, a proxy for all things economic related

Crude oil is one of the most important markets in the world, because quite frankly economies don’t run without this commodity. What was once a way to play the energy market now has developed into a way to play the overall global economy. As you can see, there is a lot of confusion in this market. We have gone back and forth between roughly $55 and $58 and are essentially “stuck” at this point. This makes a lot of sense, because quite frankly we worry about US/China trade relations, a slowing global economy in general as industrial numbers have failed around the world, just as retail sales numbers are starting to fall short. When you look at all of the headlines, it makes quite a bit of sense that we are sitting here.

Technicals

Some of the technicals worth paying attention to not only include the rectangle of consolidation, but also the green 20 day EMA that is marked on the chart. You can see just how responsive the WTI Crude Oil market is to the 20 day EMA, which is essentially where we are sitting. We also have the 50% Fibonacci retracement level above, at the scene of a gap that is closer to $60. Again, there are plenty of reasons to see why we can’t get anywhere.

That being said, the 20 day EMA has been reliable so far, and the fact that we closed as low as we did on Friday isn’t overly concerning yet, because we did the same thing on Monday, and then turned right back around. Beyond that, we see a significant amount of consolidation just below there, so there should be significant demand.

With that being the case, all things being equal it looks as if we will continue to go back and forth. Eventually we will get some type of impulsive candle that we can follow, and of course we would take that trade. Quite frankly, if we can break above the $60 gap above, this market could go shooting to the upside. However, there are no signs of that happening quite yet. This is why the market has become a very short term range bound type of situation for most participants.

The main take away

The main take away for this market is that it is probably going to be easier to rally during the day on Monday that it will be to break down. This is because of the 20 day EMA, the support that we have seen offer buying pressure more than once, and then the massive amount of order flow underneath as well. That doesn’t mean that we are going to take off to the upside, but short-term traders will continue to do quite well in this market as volume profiles certainly show that we should continue to see this type of action.

That being said, if we can get a daily close outside of this range, and decidedly so, not just a few cents, then we should have a much larger move. The worry about global growth is one of the biggest issues right now, but we also have a Federal Reserve that’s looking to stimulate the economy. Beyond that the People’s Bank of China has started to flood the market with liquidity as well, so the idea is that it should help push some demand for production, which by extension should produce demand for crude oil.

There is also the specter of OPEC cutting production, as most of those countries need higher pricing to fuel social programs. With that being the case, and of course the technicals in recent order flow, it would make sense to see buyers step right back in.