Ethereum on the precipice

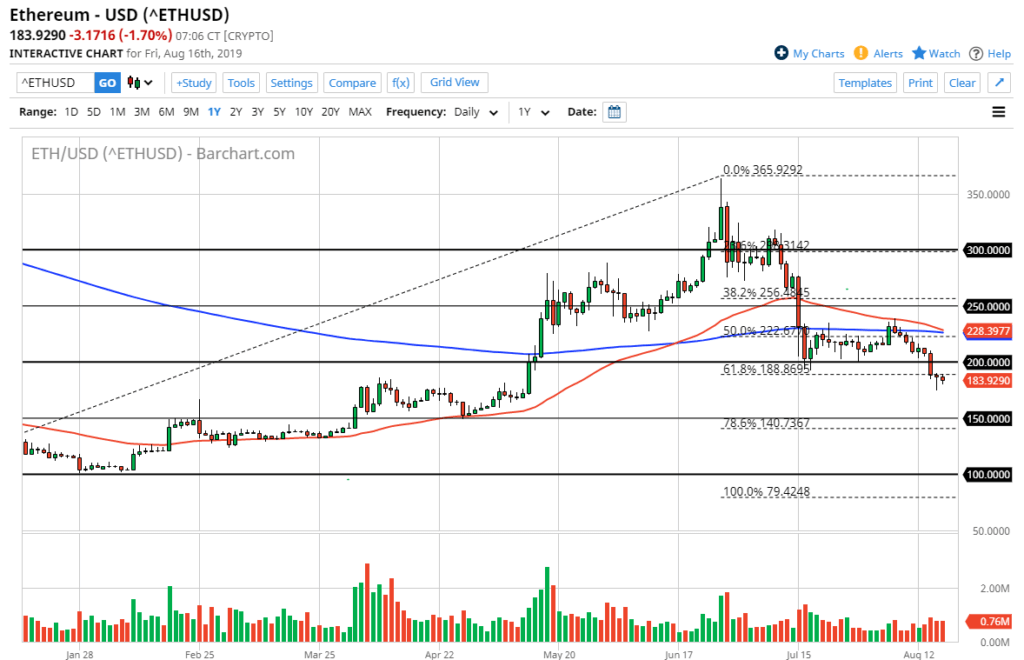

Ethereum is on the precipice of either falling apart or turning around and forming a strong rally. As I write this article, we are looking at the 61.8% Fibonacci retracement level near the $189 level offering a bit of support, and of course the Thursday candle stick was a hammer so that does bode well. However, we are starting to see something known as the “death cross”, which is when the 50 day EMA crosses below the 200 day EMA.

Ethereum

Value play?

The market could possibly be offering a value play at these low levels though, as quite often the “death cross” occurs quite late. Ultimately, it comes down to whether or not the 61.8% Fibonacci retracement level holds as well, and it’s very possible that if we can break back above the $200 level it could bring in fresh money towards the Ethereum market, taking advantage of what could be a turnaround and a run higher based upon the fact that Ethereum is cheap.

Ultimately, we will make a serious decision and you can probably take the idea of a “value play” off the table if we break down below the hammer from Thursday. That would open up the market to the idea of the $150 level which of course is a large, round, psychologically significant figure, and the scene of the 78.6% Fibonacci retracement level.

Crypto currency markets

Recently, the crypto markets have been somewhat flat after a huge run higher. As per usual, you need to pay attention to what happens with Bitcoin, because it leads the way for all the other crypto markets. Ethereum of course isn’t going to be any different as it is heavily influenced by money flowing in the digital currencies. The question now is whether or not Bitcoin can rally enough to drag the rest of the coins higher with it?

The play going forward

At this point, I believe that Ethereum does have a chance to rally, but I would give it until we break above the $200 level to get involved. At that point I would anticipate that the $230 level should offer a bit of resistance, and then eventually the $250 level after that. This of course would be the bullish case and would also need to see Bitcoin continue to find buyers.

The alternate scenario of course is that we break down below the hammer from the Thursday session, which should send this market down to the $150 level. I would anticipate a short bounce from there, but if we get down to that level it’s very likely that we will eventually break below the $150 level and go looking towards the $100 level after that. Ultimately, I suspect there is a 50-50 chance of either trade scenario, so that’s why I have these two levels to pay attention to. Between those two levels, I would stay out of the market and simply wait for the market to tell you which direction it wants to go, and simply follow after that.