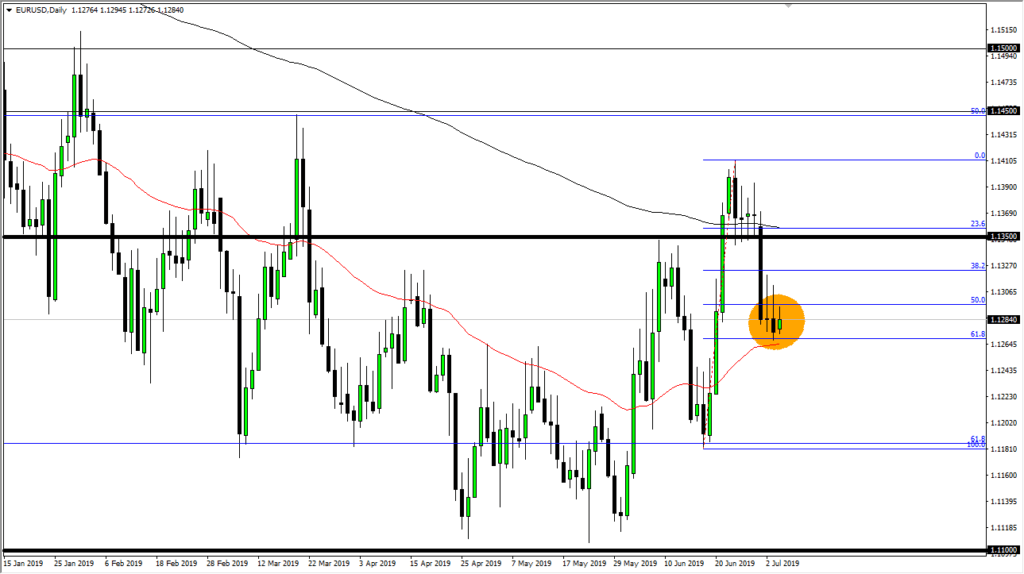

EUR/USD sitting at major confluence of support

The Euro has been hanging about the same area for three days now, showing signs of support at the 1.1275 region. That being the case, the market looks very likely to continue to hang about here as we await for the jobs number. At this point, it’s very likely that the market is going to make a major decision in the next 24 hours.

Confluence

EUR/USD chart

The confluence that I speak of is the crucial 61.8% Fibonacci retracement level that we are currently sitting on. Beyond that we have the 50 day EMA just below that of course is offering support as well. Beyond that we have the triple inverted hammer, although a very bearish sign has not kicked off yet. This is why I think that this confluence is worth paying attention to, and that we could make a significant move rather quickly.

Next impulsive candle

The next impulsive candle will be crucial for this market, as it will determine a lot of what happens next. If we get a daily close below the 50 day EMA I believe it opens up the market for a move back down to the 1.12 handle underneath. However, if we get a strong close above all three inverted hammer’s, that is an extraordinarily bullish signal and sends this market looking towards 1.1350 level, the 1.14 level, and then perhaps fresh highs. This would jive quite nicely with the recent action, as we have made “higher lows” going forward.

Federal Reserve

The Federal Reserve is of course one of the greatest influences on this pair as they are looking to cut interest rates several times. If that’s going to be the case it should weaken the greenback. However, the jobs number will come into play during the trading session on Friday so obviously we need to get past that and the expectation that comes out of that move.

The play going forward

Ultimately, the biggest signal in my opinion will be a move higher, because it goes against the grain. That means that a lot of traders will be trapped short of this pair and on the wrong side of the market. When that happens you see short covering rallies,, and it can really blow the top out of this thing.

Keep in mind that this pair is rather choppy in general so I would look for a “home run” in the short term but recognize that we are trying to determine the longer-term direction of this pair, so this tends to be a very slow and steady process, especially in the EUR/USD pair. If this does in fact determine that we are forming a massive trend change, that normally takes quite some time and what we have seen recently should confirm the attitude shift but remember that we have been in a downtrend for so long it takes quite a bit of time to break through all of those barriers. I do believe that if we eventually get above the 1.15 handle, then the market will start to accelerate. Between here and there is going to be a grind.