Euro Continues to Look Weak Against Canadian Dollar

- Euro testing lows against CAD

- Breaks significant 1.45 CAD level

- Long-term downtrend

The euro has been drifting lower against the Canadian dollar for quite some time, as well as many other currencies around the world. Looking at the way the market has bounced slightly on Friday, this is probably more or less going to be thought of as short-covering going forward. After all, the weekend has arrived, so it’s very likely that people will be trying to get out of the market in case of a sudden spike.

Euro and a whole host of issues

The euro has been falling against most currencies around the world because, quite frankly, the European Union has very poor economic fundamentals. At this point, the market will more than likely continue to punish the euro due to the Germans heading towards a recession, and the Italians already being there. With this being the case, the market also has to look at the bond yield differential between the United States and the European Union. The bonds in the EU are negative-yielding for the most part, while there are still positive yields to be found in the United States. This in and of itself will favor the greenback when it comes to the currency markets.

Significant level is broken

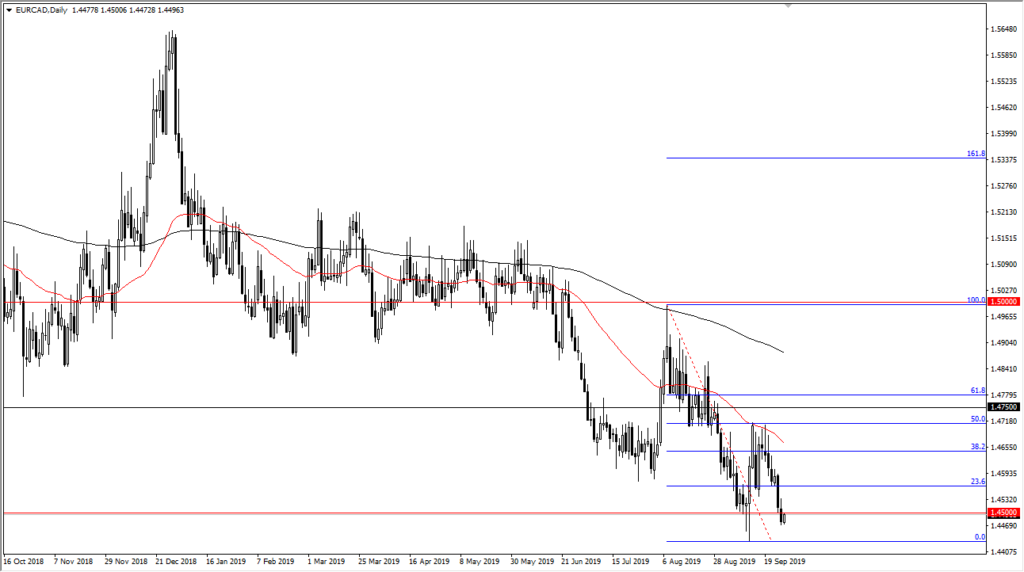

The significant 1.45 CAD level has been broken to the downside again, which of course will attract a certain amount of attention, as the round figure typically will. Ultimately, the market had bounced previously from this general vicinity, so now that we have broken through here, it’s likely that the market will continue to go much lower. Beyond all of that, the market rallied a bit during the trading session, but more than likely, the longer-term downtrend should continue to go much lower.

EURCAD technical analysis

The technical analysis

The technical analysis for this pair is quite simple. It is in a downtrend and has recently seen the 50-day EMA, painted in red on the chart, offer quite a bit of resistance as we bounced directly towards that area and then rolled right back over. At this point, the 1.4750 level and the 50% Fibonacci retracement level both offered quite a bit of resistance. Given enough time, though, it’s very likely that we will break to a fresh, new low and continue the overall selling pressure.

Selling rallies should continue to be the way going forward in this market, based on short-term candlesticks. Beyond all of that, the market will pay attention to the crude oil futures market: this has a direct influence on how strong or weak the Canadian dollar is. Oil looks as if it is trying to form a bit of a short-term base, so that could add more downward pressure in this pair. Beyond that, another chart to watch will be the EUR/USD pair, as it is the de facto standard of strength when it comes to the euro itself. Fading rallies continue to be the best trade going forward.