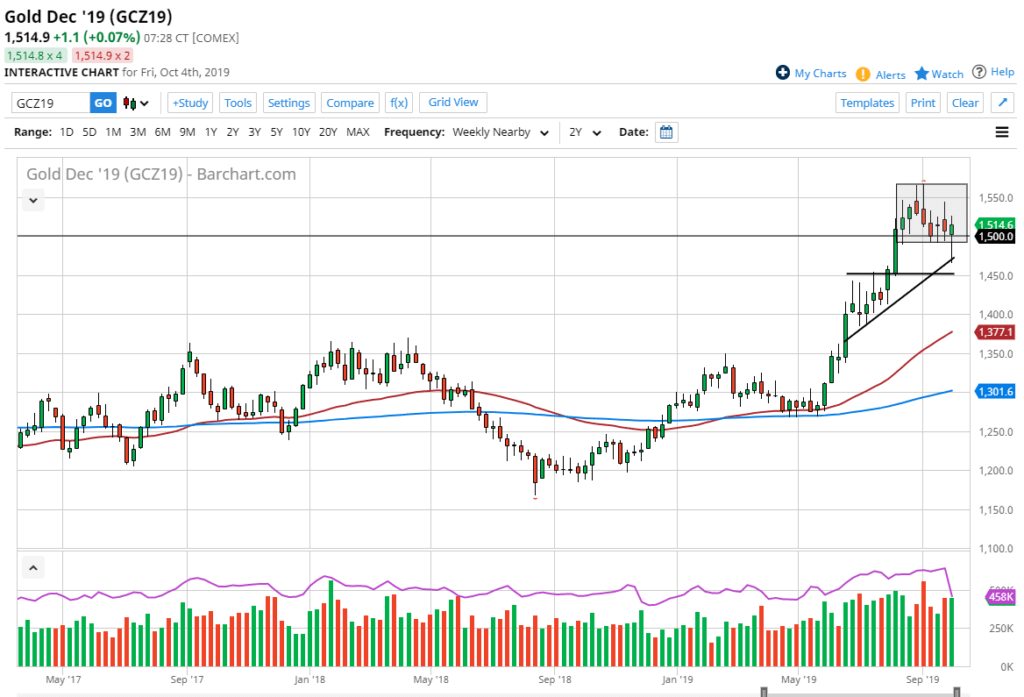

Trend Still Higher for Gold

- Bullish weekly candlestick

- Bounced from major trendline

- $1500 holds steady

The gold market has been all over the place over the previous week, but it has shown signs of strength as the market continues to recover every time it pulls back. The candlestick is a hammer which of course is a bullish formation, and the fact it has bounced from a major trendline does not hurt the bullish case either.

Gold has been increasing its strength due to central banks loosening monetary policy while cutting interest rates as well. Both of these are good for gold longer-term, so the fundamental and technical pictures for this market tend to agree. Ultimately, the trend looks likely to stay the same.

Multitude of reasons for uptrend

Gold weekly chart

Not only are there a lot of concerns when it comes to fiat currencies and monetary policy through central banks around the world, but there are a lot of geopolitical issues out there that could come into play when it comes to making a decision to buy gold. With the US/China trade situation not looking likely to go anywhere anytime soon, there are a lot of worries concerning the idea of geopolitical issues. These include Brexit, tensions in Hong Kong, and the Islamic Republic of Iran. All of these are reasons to think that gold should continue to at least attract some attention from gold buyers in the market.

Technical support

Looking at the weekly chart, it’s easy to see that the $1500 level would attract a lot of attention. Beyond that, there is also the trend line that marked the bottom of the week. A “perfect candle” here is worth paying attention to, as it shows there is quite a bit of resiliency in this market. Over the last several months, the market has been grinding from the $1300 area, and it should expect more of the same as the situation has not changed. Granted, the US economy seems to be holding together quite nicely, but the rest of the world is most certainly struggling. Although gold is typically measured in US dollars, there could be better value to be found buying gold and other currencies that have been struggling, most specifically the euro or the pound.

Either way, the market still looks very healthy and should go looking towards the highs that were made near the $1560 level. At this point, gold looks to be extraordinarily bullish, and it should continue to find plenty of buyers every time it dips on shorter-term charts. Gold will more than likely reach towards the $1800 level over the next several months.