New Zealand Dollar to Face Major Selling Pressure Above

- New Zealand dollar highly levered to Chinese situation

- Multiple sell-offs just above

- 50% Fibonacci retracement level

- Negative trend

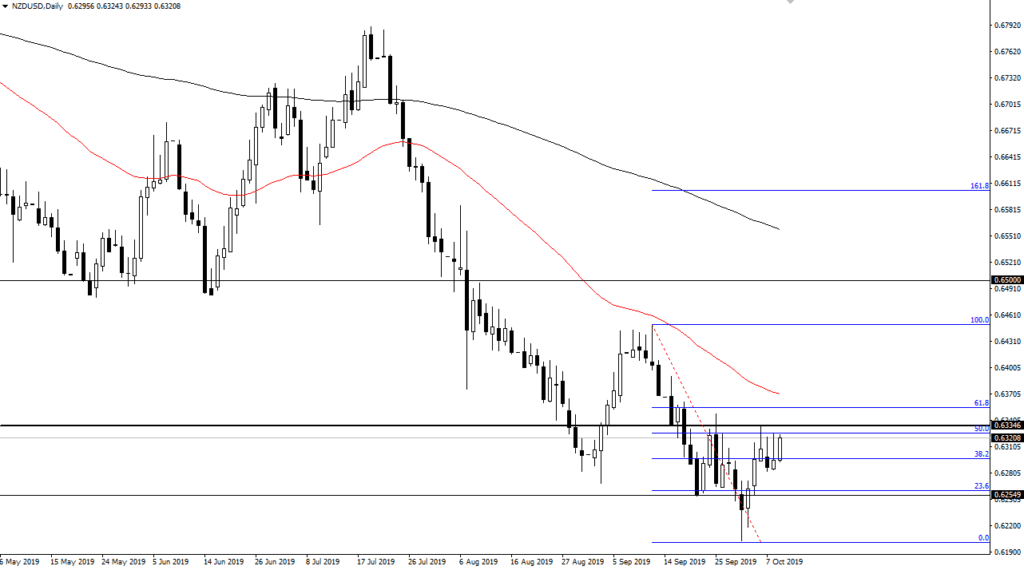

The New Zealand dollar has kicked off the Wednesday session with strength. However, as can be seen from the previous three daily candlesticks, each of these rallies has in fact sold off to form shooting stars. There is nothing on this chart that suggests that a breakout is imminent, other than the fact that there has been a significant amount of selling every time we got close to the 0.6325 level.

Technical analysis

NZD/USD chart

The technical analysis in this market has seen a lot of push and pull, and certainly it has been very resilient in its attempt to break out. However, it has failed three times already. Beyond that, it’s already starting to roll over during the day, so it’s unlikely to continue going higher. Eventually, exhaustion comes into play, and the market probably drips quite a bit lower from there.

The 50% Fibonacci retracement level is sitting just above current pricing, and the red 50-day EMA is starting to rise towards this level as well. There has been a nice bounce, but it’s just a quick bounce that you will see occasionally in a downtrend. All of that being said, if the market was to recapture the 50-day EMA, then the market would probably go looking towards the 100% Fibonacci retracement level, which is closer to the 0.6450 level above.

US/China talking

Keep in mind that the New Zealand dollar is highly sensitive to what goes on in Asia, and Asia is very sensitive to China. At this point, the Chinese have suggested that they are willing to do a partial deal: buying more soybeans from the United States. It seems the Americans are not going to accept that, and there seems to be a bit of a disconnect around the world as traders continue to believe Donald Trump will be willing to sign on. This is a severe miscalculation on the part of traders, which is quite surprising considering it has happened more than once. By the end of the week, it’s very likely that the Americans and the Chinese will have made very little progress, if any at all.

The trade going forward

The trade going forward is to simply fade this pair, unless there is a sudden surge higher based on a headline. This would have to be a real headline, not just a rumor. The 50-day EMA being broken to the upside could offer a buying opportunity. However, at the first signs of exhaustion, traders will come in and push this market lower, as headlines across the wires claim that the Americans are not willing to go along with any type of partial deal.

Unlike most politicians, the US president has a day job he can go back to, so he’s willing to take political risks.