US Dollar to Continue Noisy Trading Against Yen

- The US dollar recovers after initial sell-off

- Reverts bank to range

- Major resistance above, just as below

The US dollar had a rough ride during early trading on Monday, as the market broke down rather significantly and had its first reaction to the addition of tariffs by Donald Trump against the Chinese. By doing so, we broke the ¥105 barrier which caused quite a bit of commotion during the Tokyo session. We turned around quite rapidly though, based on a couple of headlines that came out suggesting that perhaps the Americans and the Chinese were still willing to talk.

Range-bound still

USD/JPY

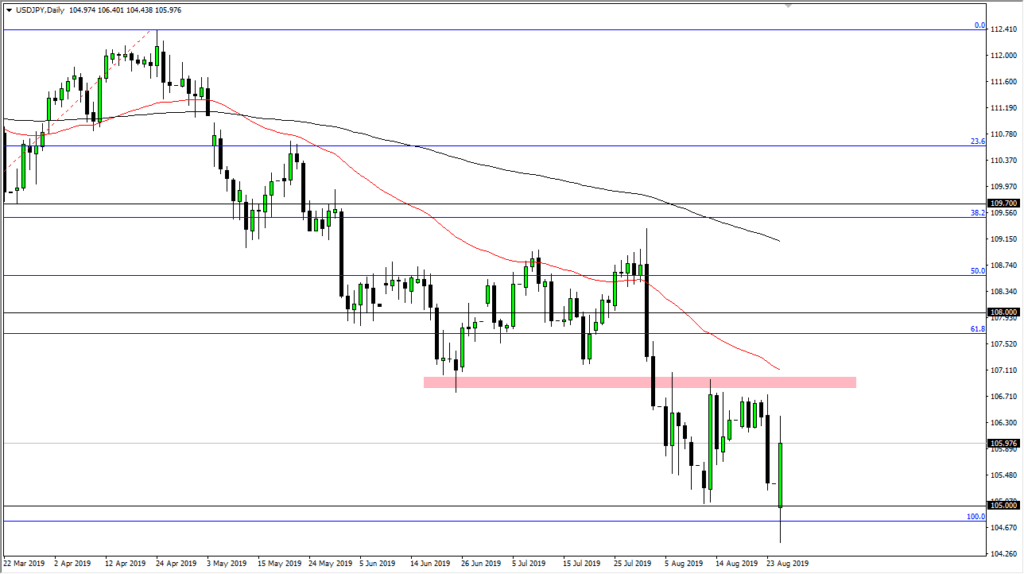

The market is still range-bound, as we have seen a lot of noise yet find ourselves in the same range that we had been in previously. The ¥107 level has offered significant resistance, just as the ¥105 level has offered significant support. With that in mind, it’s very likely that we will continue to go back and forth, showing a lot of uncertainty. This makes sense, though, because the market has so many different things to focus on. We have the US/China trade situation deteriorating still, global demand for growth-related materials falling, and the potential of recessionary headwinds and places such as Germany, while the United States has slowed down slightly.

Technical analysis

The technical analysis for this pair is relatively straightforward since the ¥107 level is a major barrier that’s going to be difficult to break. Beyond that, the 50-day EMA is starting to reach down towards that level as well, which will attract a certain amount of trading pressure. On the downside, the ¥105 level should continue to offer support based on the fact that it is a large hole number, but it is also where we see the 100% Fibonacci retracement level. Because of that, it’s very likely that we will bounce between those two areas. That being said, keep in mind that, more than anything else, this is a risk barometer going up and down with risk appetite around the world.

The trade going forward

The trade going forward is to simply continue to play this range. I think it’s going to be very difficult to break out to the upside, so I’m more than willing to fade rallies they get a little too close to the ¥107 level. On the other hand, it’s not known whether we will break down below the ¥105 level very easily. I’d be willing to buy bounces from that area. Having said that, if we did turn around and break down below the bottom of the range for the trading session on Monday, I would become aggressively short and start aiming for the ¥102.50 level. You can also use stock market charts as a secondary indicator, as they should rise and fall with this pair. As a general rule, I tend to use the S&P 500. If it does well, then this pair will typically rally. Of course, the opposite direction works as well.