Euro falls hard after hints of loose monetary policy

The Euro had a tough session early on Tuesday as Mario Draghi suggested that the ECB was opened to more quantitative easing and lower rates to combat economic weakness. If that’s going to be the case, it makes sense that the Euro will continue to struggle, but don’t get too excited about this because of the next 24 hours.

Federal Reserve

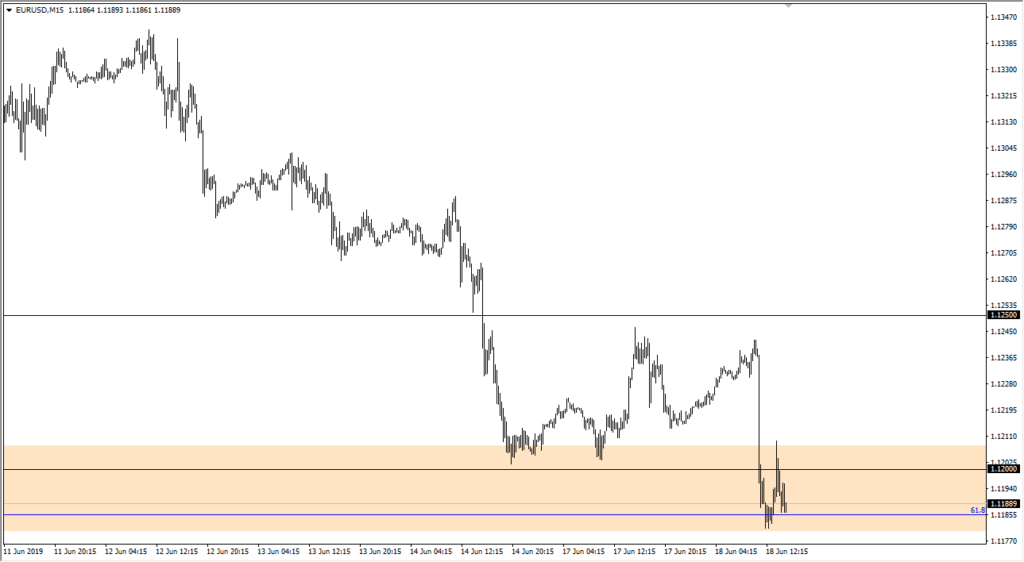

The Federal Reserve has its turn tomorrow, and it’s very likely that the FOMC Statement could suggest that the same will be coming out of the United States, and therefore it is very likely that we could see a bounce going forward. Quite frankly although it has been very negative as you can see on the 15 minute chart above, the reality is that the Federal Reserve is going to have its say as well and I suspect that what we are about to see is going to be more of the same.

At this point, central banks will be “racing to the bottom”, as they have been from time to time. If that’s going to be the case I think that we stay within the range that we have been in, between the 1.11 level and the 1.1250 level. If the Federal Reserve becomes overly bearish, they could “overpower” the ECB and send this pair much higher.

The play going forward

EUR/USD 15 min.

At this point, the EUR/USD pair is going to become even more choppy than usual. We should have a well-defined range, but if the Federal Reserve actually makes a cut during the trading session on Wednesday, something that is not likely but possible, this pair will probably shoot straight through the upper barrier that I have mentioned.

It’s very likely that what we are going to see is a lot of back-and-forth trading, and of course the summer isn’t exactly the most explosive time of year to trade. Ultimately, this is a market that likes to chop around in ranges anyways, and the fact that the ECB has loosened its monetary policy is of course going to throw more confusion in this market, and therefore I think what we are looking at is the two opposing forces that are essentially equal.

However, over the longer-term the Federal Reserve gets what it wants, and therefore I still think that even though we have had this major break down during the trading session on Tuesday, the reality is that the market is still within the range that we had been talking about. The 61.8% Fibonacci retracement level looks as if it is trying to offer a bit of support in this market, and this of course will be something that longer-term traders pay attention to. Although we have had a major selloff during the day, I don’t think much will change until after we get the Federal Reserve and its statement coming out tomorrow. Although things look bearish the moment, this could change at 2 PM Eastern Standard Time during the trading session on Wednesday just as quickly as it did today.